Shop safety posters business tax forms

(270 items found)

Sort by:

Best match

Adams 2023 1099-NEC Tax Forms Kit with Self Seal Envelopes and Adams Tax Forms Helper, 12/Pack (STAX512NEC-23)

Item #: 901-24564854

Use Form 1099-NEC to report non-employee compensation paid to independent contractors; now a continuous-use form with a fill-in-the-year date field good for multiple tax years

The 2023 1099-NEC must be mailed or eFiled to the IRS and furnished to your recipients by January 31, 2024; New IRS eFile regulations require e-Filing for 10 or more returns of certain forms; Use the new Adams Tax Forms Helper to eFile to the IRS/SSA

5-Part 1099-NEC forms print 3 to a page on 4 micro perforated sheets with copies A, C/1, B, 2 & C/1

$26.99

Per pack

Adams 2023 1099-MISC Tax Forms Kit with Adams Tax Forms Helper and 5 Free eFiles, 24/Pack (STAX5241MISC-23)

Item #: 901-24564844

Use Form 1099-MISC to report miscellaneous income and payer-made sales of $5000 or more; now a continuous use form with a fill-in-the-year date field good for multiple tax years; the previously unnumbered FATCA box is now box 13 on the 1099-MISC and

remaining boxes have been renumbered ...

remaining boxes have been renumbered ...

For paper filers, the 2023 1099-MISC Copy B is due to your recipients by Jan. 31, 2024 (if box 8 & 10 are empty) or Feb. 15 (if filled); Copy A & 1096 are due by Feb. 28; or eFile by Apr. 1, 2024; New IRS eFile regulations require e-Filing for 10 or ...

$40.99

Per pack

Adams 2023 1099-MISC Tax Forms with 1096 Forms, 5-Part, 50/Pack (STAX550MISC-23)

Item #: 901-24564843

Use Form 1099-MISC to report miscellaneous income and payer-made sales of $5000 or more; now a continuous-use form with a fill-in-the-year date field good for multiple tax years; the previously unnumbered FATCA box is now box 13 on the 1099-MISC and

remaining boxes have been renumbered ...

remaining boxes have been renumbered ...

For paper filers, the 2023 1099-MISC Copy B is due to your recipients by Jan. 31, 2024 (if box 8 & 10 are empty) or Feb. 15 (if filled); Copy A & 1096 are due by Feb. 28; or eFile by Apr. 1, 2024; New IRS eFile regulations require e-Filing for 10 or ...

$39.99

Per pack

Adams 2023 W2 Tax Forms Kit with Adams Tax Forms Helper and 10 Free eFiles, 50/Pack (STAX650W-23)

Item #: 901-24564835

Use Form W-2 to report employee wages, tips and taxes withheld to the Social Security Administration and your employees

2023 W-2 forms must be mailed or eFiled to the SSA and furnished to your employees by January 31, 2024; New IRS eFile regulations require e-Filing for 10 or more returns of certain forms; Use the new Adams Tax Forms Helper to eFile to the IRS/SSA

6-Part W-2 forms print 2 to a page on 25 micro perforated sheets with copies A, D/1, B, C, 2 and D/1

$44.99

Per pack

Adams 2023 1099-MISC Continuous-Feed Tax Forms with 1096 Forms, 5-Part, 24/Pack (STAX524MISC-23)

Item #: 901-24564838

Use Form 1099-MISC to report miscellaneous income and payer-made sales of $5000 or more; now a continuous-use form with a fill-in-the-year date field good for multiple tax years; the previously unnumbered FATCA box is now box 13 on the 1099-MISC and

remaining boxes have been renumbered ...

remaining boxes have been renumbered ...

For paper filers, the 2023 1099-MISC Copy B is due to your recipients by Jan. 31, 2024 (if box 8 & 10 are empty) or Feb. 15 (if filled); Copy A & 1096 are due by Feb. 28; or eFile by Apr. 1, 2024; New IRS eFile regulations require e-Filing for 10 or ...

$24.99

Per pack

TOPS 2023 1099-NEC Tax Form, 4-Part, 50/Pack (6103NECQ)

Item #: 901-6103NECQ

Form 1099-NEC records all nonemployee compensation to the IRS and recipients, replacing Box 7 on the 1099-MISC

The 2023 1099-NEC must be mailed or e-filed to the IRS and furnished to your recipients by February 1, 2024

4-Part 1099-NEC forms print 3 to a page; includes 17 micro perforated sheets for each of copy A and B and 34 micro perforated sheets of Copy C to be used as Payer, State or Copy 2 copies

$47.99

Per pack

Adams 2023 1099-NEC Tax Forms Kit with Adams Tax Forms Helper and 10 Free eFiles, 50/Pack (STAX550NEC-23)

Item #: 901-24564837

Use Form 1099-NEC to report non-employee compensation paid to independent contractors; now a continuous-use form with a fill-in-the-year date field good for multiple tax years

The 2023 1099-NEC must be mailed or eFiled to the IRS and furnished to your recipients by January 31, 2024; New IRS eFile regulations require e-Filing for 10 or more returns of certain forms; Use the new Adams Tax Forms Helper to eFile to the IRS/SSA

5-Part 1099-NEC forms print 3 to a page on 17 micro perforated sheets with copies A, C/1, B, 2 & C/1

$37.99

Per pack

Adams 2023 1099-NEC Tax Forms Kit with Adams Tax Forms Helper and 5 Free eFiles, 24/Pack (STAX5241NEC-23)

Item #: 901-24564842

Use Form 1099-NEC to report non-employee compensation paid to independent contractors; now a continuous-use form with a fill-in-the-year date field good for multiple tax years

The 2023 1099-NEC must be mailed or eFiled to the IRS and furnished to your recipients by January 31, 2024; New IRS eFile regulations require e-Filing for 10 or more returns of certain forms; Use the new Adams Tax Forms Helper to eFile to the IRS/SSA

5-Part 1099-NEC forms print 3 to a page on 8 micro perforated sheets with copies A, C/1, B, 2 & C/1

$30.99

Per pack

TOPS 2023 1099-MISC Tax Form, 1-Part, Copy C/2 Payer or State, 100/Pack (LMISCPAY2)

Item #: 901-5112

As of 2023, you'll use Form 1099-MISC solely to report miscellaneous income to the IRS and your recipients, including rents, royalties and other types of income payments

For paper filers, the 2023 1099-MISC Copy B is due to your recipients by Feb. 1, 2023 (if box 8 and 10 are empty) or Feb. 16 (if filled); Copy A and 1096 must be mailed to the IRS by March 1, 2023; or e-file by March 31, 2023

Copy C or Copy 2 forms print 2 to a page on 50 micro perforated sheets

$15.59

Per pack

ComplyRight 2023 1099-MISC Tax Form, 5-Part, 2-Up, Copy A/State/B/C/2, 25/Pack (7154525)

Item #: 901-24507920

File form 1099-MISC for each person in the course of your business to whom you have paid during the year

5-part, 2-up: Copies A/State/B/C/2

For laser printers

$33.99

Per each

Adams 2023 1099-NEC Continuous-Feed Tax Forms with 1096 Forms, 5-Part, 24/Pack (STAX524NEC-23)

Item #: 901-24564846

Use Form 1099-NEC to report non-employee compensation paid to independent contractors; now a continuous-use form with a fill-in-the-year date field good for multiple tax years

The 2023 1099-NEC must be mailed or eFiled to the IRS and furnished to your recipients by January 31, 2024; New IRS eFile regulations require e-Filing for 10 or more returns of certain forms; Try the new Adams Tax Forms Helper to eFile to the IRS/SSA

5-Part 1099-NEC carbonless forms print 3 to a page on 8 micro perforated sheets with copies A, 1, B, 2 & C

$27.99

Per pack

Medical Arts Press® End-Tab Folders with Double Back Pockets; Fastener Position 1

Item #: 901-50688

This allows the folder to still have two fasteners installed, yet provide two pockets

The pockets are designed with the opening at the top while in use so loose items are less likely to come out

Perfect for any application which involves the storage of small images, x-rays, check stubs, odd forms, photographs and many others

$67.99

1-4 box

Save 2%

$65.99

5+ box

TOPS 2023 1099-NEC Tax Form Kit with Software & Envelopes, 5-Part, 100/Pack (LNEC5WSKIT-S)

Item #: 901-24450259

Form 1099-NEC records all nonemployee compensation to the IRS and recipients, replacing Box 7 on the 1099-MISC

Five-part tax forms

Tax forms are inkjet and laser printer compatible

$120.99

Per pack

TOPS 2023 1099-NEC Tax Form, Copy B, 50/Pack (LNECREC-S)

Item #: 901-24450255

Form 1099-NEC records all nonemployee compensation to the IRS and recipients, replacing Box 7 on the 1099-MISC

Recipient Copy B laser cut sheet form

Tax forms are inkjet and laser printer compatible

$12.99

Per pack

TOPS 2023 W-2 Tax Form, 1-Part, Copy 1/D, 100/Pack (LW2ERQ)

Item #: 901-5204

W-2 Tax Forms for every employer with one or more employees to report employee wages, tips, Federal Income and Social Security Tax withheld by the Federal Government

1 part Copy 1/D cut sheet laser form

Printed in black ink

$9.99

1 pack

Save 22%

$7.79

5+ pack

TOPS 2023 1099-NEC Tax Form Kit with Envelopes, 4-Part, 50/Pack (LNEC425Q)

Item #: 901-LNEC425Q

Form 1099-NEC records all nonemployee compensation to the IRS and recipients, replacing Box 7 on the 1099-MISC

The 2023 1099-NEC must be mailed or e-filed to the IRS and furnished to your recipients by February 1, 2023

4-Part 1099-NEC forms print 3 to a page; includes 17 micro perforated sheets of copies A and B and 50 micro perforated sheets of Copy C to be used as Payer, State, or Copy 2 copies

$38.99

Per pack

Adams 2023 1099-MISC eFile Tax Forms Kit, w/ Self Seal Envelopes, Access to new Adams Tax Forms Helper, 12/Pack (STAX512MISC-23)

Item #: 901-24564840

Use Form 1099-MISC to report miscellaneous income and payer-made sales of $5000 or more; now a continuous-use form with a fill-in-the-year date field good for multiple tax years; the previously unnumbered FATCA box is now box 13 on the 1099-MISC and

remaining boxes have been renumbered ...

remaining boxes have been renumbered ...

For paper filers, the 2023 1099-MISC Copy B is due to your recipients by Jan. 31, 2024 (if box 8 & 10 are empty) or Feb. 15 (if filled); Copy A & 1096 are due by Feb. 28; or eFile by Apr. 1, 2024; New IRS eFile regulations require e-Filing for 10 or ...

$25.99

Per pack

TOPS 2023 1099-MISC Tax Form with 3 1096 Forms, 4-Part, 50/Pack (6103Q)

Item #: 901-6103

As of 2023, you'll use Form 1099-MISC solely to report miscellaneous income to the IRS and your recipients, including rents, royalties and other types of income payments

For paper filers, the 2023 1099-MISC Copy B is due to your recipients by Feb. 1, 2023 (if box 8 and 10 are empty) or Feb. 16 (if filled); Copy A and 1096 must be mailed to the IRS by March 1, 2023; or e-file by March 31, 2023

5-Part 1099-MISC forms print 2 to a page on 25 micro perforated sheets with copies A, C, B, 2 & C

$27.99

Per pack

TOPS 2023 1099-NEC Tax Form, 1-Part, Copy A, 50/Pack (LNECFED16)

Item #: 901-LNECFED16

Form 1099-NEC records all nonemployee compensation to the IRS and recipients, replacing Box 7 on the 1099-MISC

The 2023 1099-NEC must be mailed or e-filed to the IRS and furnished to your recipients by February 1, 2023

Federal Copy A sheets are printed 3 to a page on 50 micro perforated sheets

$11.99

Per pack

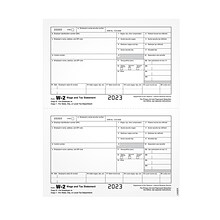

Adams 2023 W-2 Tax Form, 6-Part, 2-Up, 12/Pack (STAX612-23)

Item #: 901-24564845

Use Form W-2 to report employee wages, tips and taxes withheld to the S+F20ocial Security Administration and your employees

2023 W-2 forms must be mailed or eFiled to the SSA and furnished to your employees by January 31, 2024; New IRS eFile regulations require e-Filing for 10 or more returns of certain forms; Use the new Adams Tax Forms Helper to eFile to the IRS/SSA

6-Part W-2 forms print 2 to a page on 6 micro perforated sheets with copies A, D/1, B, C, 2 and D/1

$28.99

Per pack

TOPS 2023 1099-MISC Tax Form, 50/Pack (LMISCREC-S)

Item #: 901-920081

1099-MISC Tax Forms are used to report rents, royalties, prizes and awards, fishing boat proceeds, fees, commissions paid to non-employees, receipts of medical and health care payments, and substitute payments in lieu of dividends or interest

50 sheets per pack, 2 forms per sheet

Laser/inkjet printer compatible

$12.99

Per pack

TOPS 2023 1099-MISC Tax Form, 5-Part, 100/Pack (LMISC5KIT-S)

Item #: 901-920071

1099-MISC Tax Forms are used to report rents, royalties, prizes and awards, fishing boat proceeds, fees, commissions paid to non-employees, receipts of medical and health care payments, and substitute payments in lieu of dividends or interest

5-Part kit includes copies A, B, C, 2 & C, 1096 forms, and double window envelopes

Laser/inkjet printer compatible

$74.99

Per pack

TOPS 2023 1099-DIV Tax Form, 1-Part, Federal Copy A, 100/Pack (LDIVFED16)

Item #: 901-5130

1099DIV Tax Forms used to report gross dividends and other distributions on stock, investment expenses, capital gain dividends, non-taxable distributions and liquidation distribution

1 part Copy A laser cut sheet form

Laser printer compatible

$14.99

Per pack