Sort by:

Best match

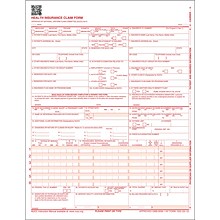

ComplyRight CMS-1500 Health Insurance Claims, 2500/Pack (CMS12LC)

Item #: 901-125557

Includes QR code identifier at the top of the form that supports and aligns with Industry scanning systems

Printed with OCR "dropout" red ink on 20lb. paper (per government regulations)

Includes new QR code identifier at the top of the form that supports and aligns with Industry scanning systems

ComplyRight 2025 1099-NEC Tax Form 25 self-seal envelopes, 4-Part, 3-Up, Copy A, B, C/2, 1096 Transmittal, 25/Pack (NEC6103E25)

Item #: 901-24578199

1099-NEC (nonemployee compensation) is an IRS form created for companies to report payments made to an individual who performed services in the course of business as a nonemployee

Includes four-part tax forms

3-Up forms: three forms on a single sheet

Adams 2-Part Carbonless Receipt Book, 5" x 11", 200 Sets/Book (SC1152)

Item #: 901-SC1152

Money/rent receipt book for recording rent payments and other payments

White originals and canary duplicates and made of carbonless paper

Contains 200 receipts per book; four forms per page

ComplyRight 2025 1099-NEC Tax Form 50 self-seal envelopes, 4-Part, 3-Up, Copy A, B, C/2, 1096 Transmittal, 50/Pack (NEC6103E)

Item #: 901-24578200

1099-NEC (nonemployee compensation) is an IRS form created for companies to report payments made to an individual who performed services in the course of business as a nonemployee

Includes four-part tax forms

3-Up forms: three forms on a single sheet

ComplyRight 2025 W-2 Tax Form, 3-Part, 3-Up, 50/Pack (521150)

Item #: 901-24508152

W-2 forms provide wage and income information to your employees, the SSA, the IRS, and state and local governments

3-up (horizontal format) forms

For laser printers

Adams® Carbonless Receipt Book, 3" x 8", 2-Part, 200 Sets/Book (SC1182)

Item #: 901-SC1182

Rent receipt books for recording monthly financial payments

Carbonless paper creates white originals and canary duplicates

Four forms per page and 50 pages; 200 forms per book

ComplyRight 2025 1099-MISC Tax Form Envelopes, 3-Part, 2-Up, Copy A, B, C/2, 1096 Transmittal, 25/Pack (6103E25)

Item #: 901-24578221

1099-MISC tax form is designed to report payments made in the course of your business for each person to whom you paid at least 10 dollars in royalties or at least 600 dollars in rents

Consists of three parts

Tax form page format: 2-Up

Adams Employee's Copies Cut Sheet 2025 1096 Tax Form, 1-Part, 25/Pack (L109625)

Item #: 901-5100Q

2025 1096 Annual Summary and Transmittal of U.S. Information Returns

A 1096 summary transmittal form must accompany each type of 1099 mailed to the IRS—due dates will vary by form

1-Part 1096 Annual Summary and Transmittal of U.S. Information Returns

Adams Employee's Copies Cut Sheet 2025 1099-NEC Tax Form Kit with Envelopes, 4-Part, Copy A, B, 1, 2, 25/Pack (LNEC413)

Item #: 901-LNEC413

2025 4-Part 1099-NEC Forms with Envelopes for 25 recipients and 3 1096 forms

The 2025 1099-NEC must be mailed or eFiled to the IRS and furnished to your recipients by February 2, 2026; As of 2023, IRS eFile regulations require e-Filing for 10 or more returns of certain forms; Use the new Adams Tax Forms Helper to eFile to the

IRS/SSA ...

IRS/SSA ...

Adams Employee's Copies Cut Sheet 2025 Blank W-2 Tax Form, 1-Part, 2-Up, 100/Pack (BLW2Q)

Item #: 901-5207

2025 Blank W-2 Forms for up to 100 employees

2025 W-2 forms must be mailed or eFiled to the SSA and furnished to your employees by February 2, 2026; IRS eFile regulations require e-Filing for 10 or more returns of certain forms; Use Adams Tax Forms Helper to eFile to the IRS/SSA

Blank W-2 forms with blank backers

ComplyRight 2025 1099-MISC Tax Form, 1-Part, 3-Up, Recipient Blank, 50/Pack (517350)

Item #: 901-24507974

File form 1099-MISC for each person in the course of your business to whom you have paid during the year

Single-part, 3-up: Recipient Copy B/C with C backer information

For laser printers

Tabbies 3-Part Patient Sign-in Label Forms, 125/Pack (14532)

Item #: 901-2678548

Patient sign-in label forms to sign in your patients confidentially

Form consists of three parts: a label sheet, a carbon sheet, and a log behind it

125 sheets per package

Adams Employee's Copies Cut Sheet 2025 W-2 Tax Form, 1-Part, Copy A, 100/Pack (LW2FEDAW3)

Item #: 901-5201

2025 1-Part W-2 Copy A Forms for 100 employees and 6 W-3 forms

2025 W-2 forms must be mailed or eFiled to the SSA and furnished to your employees by February 2, 2026; IRS eFile regulations require e-Filing for 10 or more returns of certain forms; Use Adams Tax Forms Helper to eFile to the IRS/SSA

1-Part W-2 Copy A sheets

Adams 2025 1099-NEC Tax Forms Kit, 4-Part, 3-Up, A, 1, B & 2, 12/Pack (STAX512NEC-25)

Item #: 901-24639719

2025 1099-NEC kit includes 12 4-part 1099-NEC forms, 3 1096 forms, 12 self-seal envelopes and access to Adams Tax Forms Helper

The 2025 1099-NEC must be mailed or eFiled to the IRS and furnished to your recipients by February 2, 2026

1099-NEC forms are 4-part

Adams 2025 1099-MISC Tax Forms Kit, 4-Part, 2-Up, A, 1, B & 2, 12/Pack (STAX512MISC-25)

Item #: 901-24639716

2025 1099-MISC kit includes 12 4-part 1099-MISC forms, 12 self-seal envelopes, 3 1096 forms and access to Adams Tax Forms Helper

For paper filers, the 2025 1099-MISC Copy B is due to your recipients by February 2, 2026 (if box 8 & 10 are empty) or Feb; 16 (if filled); Copy A & 1096 are due by March 2; eFile by March 31, 2026

1099-MISC forms are 4-part

ComplyRight 2025 W-2 Tax Form, 4-Part, 2-Up, 25/Pack (5645E25)

Item #: 901-24650566

Form W-2 and transmittal Form W-3 for reporting wages and tax statements

4-Part Set Includes: Copy A, B, C, D (13 Sheets each) 3 Transmittals and 25 Self-Seal Envelopes

2-Up: 2 Forms per Sheet

ComplyRight 2026 Attendance Calendar Card, 25 Forms/Pack (A4000W25)

Item #: 901-2548993

Calendar format on front of form makes noting absences quick and easy

Simple coding system included to aid in quickly identifying troubling patterns

Provides legal "backup" for personnel decisions, such as disciplinary action or termination

ComplyRight 2025 W-3 Tax Form, 1-Part, Transmittal, 25/Pack (520025)

Item #: 901-24507961

W-3 summary transmittal form is used to report total annual earnings, Social Security wages, Medicare wages, and withholding for all your employees to the Social Security Administration.

Transmittal Form

1 Page Equals 1 Form

TaxRight 2025 1099-NEC Tax Form Tax Forms, Envelopes & TipSheet, 4-Part, 50/Pack (NECSC6103E)

Item #: 901-24461402

1099-NEC (4-Part) tax form set with envelopes.

Includes (3) 1096 transmittal forms.

Features ComplyRight tips for optimal, compliant use - Covers minimum requirements, penalties, common errors and employer do's and don'ts.

ComplyRight CMS-1500 Health Insurance Claim Form, 250/Box (CMS12LC250)

Item #: 901-CMS12LC250

Approved by the National Uniform Claim Committee (NUCC); HIPAA compliant

This form was revised to align the paper form with some of the changes in the electronic healthcare claims: Professional (837), 005010X222 Technical Report Type 3 (5010) and 005010X222A1 Technical Report Type 3 (5010A1)

The most significant change was the addition of 8 diagnosis codes in field 21

Adams Employee's Copies Cut Sheet 2025 1099-NEC Tax Form, 6-Part, Copy B, 50/Pack (LNECREC-S)

Item #: 901-24450255

2025 1-Part 1099-NEC Copy B Forms for 150 recipients

The 2025 1099-NEC must be mailed or eFiled to the IRS and furnished to your recipients by February 2, 2026; As of 2023, IRS eFile regulations require e-Filing for 10 or more returns of certain forms; Use the new Adams Tax Forms Helper to eFile to the

IRS/SSA ...

IRS/SSA ...

ComplyRight 2025 W-2 Tax Form, 6-Part, 2-Up, 25/Pack (5650E25)

Item #: 901-24650568

Form W-2 and transmittal Form W-3 for reporting wages and tax statements

6-Part Set Includes: Copy A, B, C, 2, D, 1 (13 Sheets each) 3 Transmittals and 25 Self-Seal Envelopes

2-Up: 2 Forms per Sheet

ComplyRight 2025 1099-MISC Tax Form, 1-Part, 2-Up, Federal Copy A, 25/Pack (511025)

Item #: 901-24431083

1099-MISC tax form for payments, such as miscellaneous income made in the course of a trade or business

2-Up Federal Copy A tax forms

Single part

Adams Employee's Copies Cut Sheet 2025 W-3 Tax Form, 1-Part, 25/Pack (LW325)

Item #: 901-5200Q

2025 W-3 Summary Transmittal Forms

A W-3 must accompany each submission of W-2 forms to the Social Security Administration

1-Part W-3 Transmittal of Wage and Tax Statements