Page 8 of hippa business tax forms

(261 items found)

Sort by:

Best match

ComplyRight Self Seal Security Tinted Double-Window Tax Envelopes, 3 7/8" x 8 3/8", 50/Pack (DW19WS50)

Item #: 901-24507904

Double-window envelope for 3-Up 1099 tax form.

Self-sealing for added convenience.

Pack of 50 envelopes.

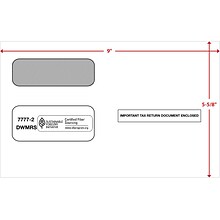

ComplyRight Self Seal Security Tinted Double-Window Tax Envelopes, White, 25/Pack (7777225)

Item #: 901-24507916

Double-window envelope for 2-Up 1099 tax form.

Self-sealing for added convenience.

Pack of 25 envelopes.

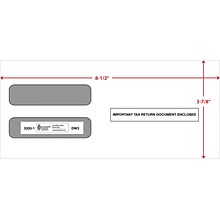

ComplyRight Moistenable Glue Security Tinted Double-Window Tax Envelopes, 3 7/8" x 8.5", 50/Pack (3333150)

Item #: 901-24507948

Double-window envelope for W-2 (5210/5211) tax form.

Features a moisture/gum-seal flap.

Pack of 50 envelopes.

ComplyRight Moistenable Glue Security Tinted Double-Window Tax Envelopes, 3 7/8" x 8 3/8", 50/Pack (DW19W)

Item #: 901-24507972

Double-window envelope for 3-Up 1099 tax form.

Features a moisture/gum-seal flap.

Pack of 50 envelopes.

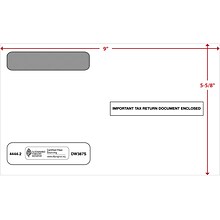

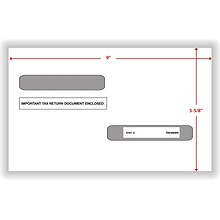

ComplyRight Self Seal Security Tinted Double-Window Tax Envelopes, 5 5/8" x 9", 50/Pack (444250)

Item #: 901-24507915

Double-window envelope for W-2 (5206/5208) tax form.

Self-sealing for added convenience.

Pack of 50 envelopes.

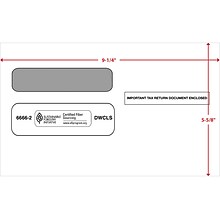

ComplyRight Self Seal Security Tinted Double-Window Tax Envelopes, 5 5/8" x 9.25", 25/Pack (6666225)

Item #: 901-24507914

Double-window envelope for 2-Up W-2 tax form.

Self-sealing for added convenience.

Pack of 25 envelopes.

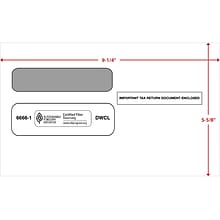

ComplyRight Self Seal 1099-R Tax Double-Window Envelope, 5.63" x 9", White, 100/Pack (DW4MWS)

Item #: 901-24578233

Double-window envelope for the 4-up 1099-R tax form

Dimensions: 5.63" x 9"

Comes in white

ComplyRight Moistenable Glue Security Tinted Tax Envelope, White, 100/Pack (61611100)

Item #: 901-24431090

Double-window envelope accommodates 4-Up 1099-R (5175) forms.

Features a moisture/gum-seal flap.

Pack of 100 envelopes.

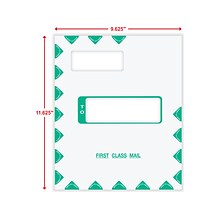

ComplyRight Self-Seal Tax Envelope, 11.63" x 9.63", White/Green, 50/Pack (PEV48)

Item #: 901-24588701

Double-window multipurpose tax return envelope will dress up every tax return and report from your office

Dimensions: 11.63" x 9.63"

Made of paper in white with green accents

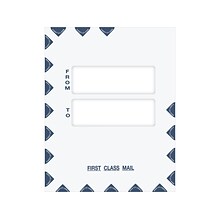

ComplyRight First Class Moisture Seal Tax Envelope, 9.5" x 12", White/Blue, 50/Pack (PES45)

Item #: 901-24588693

Multipurpose tax return envelope quickly seals and protects data that will dress up every tax return and report from your office

Dimensions: 9.5" x 12"

Made of paper in white with blue accents

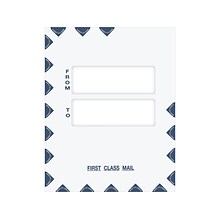

ComplyRight First Class Peel & Seal Tax Envelope, 9.5" x 12", White/Blue, 50/Pack (PEO41)

Item #: 901-24588702

Multipurpose tax return envelope quickly seals and protects data that will dress up every tax return and report from your office

Dimensions: 9.5" x 12"

Made of paper in white with blue accents

ComplyRight Moistenable Glue Tax Envelope, 9.5" x 12", White/Blue, 50/Pack (PRK37)

Item #: 901-24588707

Double-window multipurpose tax return envelope will dress up every tax return and report from your office

Dimensions: 9.5" x 12"

Made of paper in white with blue accents

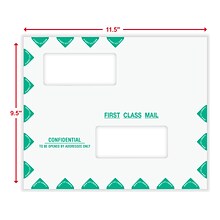

ComplyRight Self-Seal Tax Envelope, 9.5" x 11.5", White/Green, 50/Pack (PEV22)

Item #: 901-24588706

Double-window multipurpose tax return envelope will dress up every tax return and report from your office

Dimensions: 9.5" x 11.5"

Made of paper in white with green accents

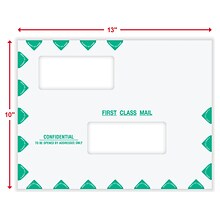

ComplyRight Self-Seal Tax Envelope, 10" x 13", White/Green, 50/Pack (PEB02)

Item #: 901-24588696

Double-window multipurpose tax return envelope will dress up every tax return and report from your office

Dimensions: 10" x 13"

Made of paper in white with green accents

ComplyRight Moistenable Glue Security Tinted Double-Window Tax Envelopes, 5 5/8" x 9.25", 50/Pack (6666150)

Item #: 901-24507911

Double-window envelope for W-2 tax form.

Features a moisture/gum-seal flap.

Pack of 50 envelopes.

ComplyRight Self Seal Security Tinted Double-Window Tax Envelopes, 5 5/8" x 9.25", 100/Pack (66662100)

Item #: 901-24431088

Double-window envelope accommodates W-2 forms.

Features a self-seal latex flap.

Pack of 100 envelopes.

Custom Florist Register Form, Classic Design, Large Format, TAX. DEL., 2 Parts, 1 Color Printing, 5 1/2" x 8 1/2", 500/Pack

Item #: 901-D6722B

Multiple layout options: Choice of different layouts for tax and delivery options - Layout A: Del, Tax, Layout B: Tax, Del, Layout C: Blank, Layout D: Tax

Compatible with our registers

Additional customization options include imprinting your custom logo

Custom Florist Register Form, Classic Design, Large Format, TAX. DEL., 3 Parts, 1 Color Printing, 5 1/2" x 8 1/2", 500/Pack

Item #: 901-D6723B

Multiple layout options: Choice of different layouts for tax and delivery options - Layout A: Del, Tax, Layout B: Tax, Del, Layout C: Blank, Layout D: Tax

Compatible with our registers

Additional customization options include imprinting your custom logo

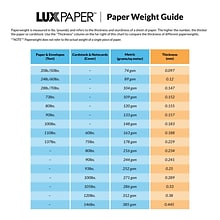

LUX W-2 / 1099 Envelopes (5 3/4 x 8) 50/Pack, White (7489-W2-50)

Item #: 901-23995716

Comes in White

Dimensions: 5.75"L x 8"W

Moistenable Glue Sealing Method

LUX W-2 / 1099 Envelopes (5 3/4 x 8) 250/Pack, White (7489-W2-250)

Item #: 901-23996254

Comes in White

Dimensions: 5.75"L x 8"W

Moistenable Glue Sealing Method

LUX W-2 / 1099 Envelopes (5 3/4 x 8) 1000/Pack, White (7489-W2-1000)

Item #: 901-23995922

Comes in White

Dimensions: 5.75"L x 8"W

Moistenable Glue Sealing Method

LUX W-2 / 1099 Envelopes (5 3/4 x 8) 500/Pack, White (7489-W2-500)

Item #: 901-23995918

Comes in White

Dimensions: 5.75"L x 8"W

Moistenable Glue Sealing Method

TurboTax Business 2025 Federal Only + E-file for 1 User, Windows 11, Download, INT940800V148

Item #: 901-24671813

Recommended if you have a partnership, own an S or C Corp, Multi-Member LLC, manage a trust or estate, or need to file a separate tax return for your business

Includes 5 Federal e-files. Business State forms sold separately via download. Get U.S.-based technical support (hours may vary).

Prepare and file your business or trust taxes with confidence

This product is not eligible for earning points.

Adams Self Seal Security Tinted Double Window Envelope, 3.75" x 8.5", White, 100/Pack (S1099-3PS)

Item #: 901-24496514

Simple, high-quality envelope for 1099-NEC tax forms

Dimensions: 3.75" x 8.5"

Made of white paper