Page 5 of 1098 carbonless forms

(2994 items found)

Sort by:

Best match

ComplyRight 2025 Blank Tax Form for 1099, 1098, 5498, 3-Up, 1500/Pack (5145B)

Item #: 901-24650549

Blank Tax Form for 1099, 1098, 5498

Horizontal Perforations without Stub

Pack of 1,500 Forms

Custom Florist Register Form, Classic Design, Large Format, TAX. DEL., 2 Parts, 1 Color Printing, 5 1/2" x 8 1/2", 500/Pack

Item #: 901-D6722B

Multiple layout options: Choice of different layouts for tax and delivery options - Layout A: Del, Tax, Layout B: Tax, Del, Layout C: Blank, Layout D: Tax

Compatible with our registers

Additional customization options include imprinting your custom logo

ComplyRight 2024 ADA Dental Claim Forms, 2,500 Forms/Pack (20241)

Item #: 901-24602226

Forms conform to the Health Insurance Portability and Accountability Act (HIPAA)

Forms provide a common format for reporting dental services to a patient's dental benefit plan

ADA policy promotes use and acceptance latest version ADA Dental Claim Forms by dentists and payers

Custom Florist Register Form, Classic Design, Large Format, TAX. DEL., 3 Parts, 1 Color Printing, 5 1/2" x 8 1/2", 500/Pack

Item #: 901-D6723B

Multiple layout options: Choice of different layouts for tax and delivery options - Layout A: Del, Tax, Layout B: Tax, Del, Layout C: Blank, Layout D: Tax

Compatible with our registers

Additional customization options include imprinting your custom logo

TOPS 2-Part Money/Rent Receipt Book, 5.37" x 2.75", White, 50 Forms (46820)

Item #: 901-745091

5 3/8" x 2 3/4"

50 ruled forms

1 form per page

ComplyRight 2026 Time Off Request and Approval Form, 2-Part, 50 Forms/Pack (A0030)

Item #: 901-24202397

Calendar format makes it easy for employees to select and submit time off requests

Ensures a consistent request and approval process for all employees

Attorney-approved to ensure 100% compliance

ComplyRight 2026 Time Off Request and Approval Form, 2-Part, 50 Forms/Pack (A0045)

Item #: 901-24202398

Calendar format makes it easy for employees to select and submit time off requests

Ensures a consistent request and approval process for all employees

Attorney-approved to ensure 100% compliance

Adams 2025 W-2 Tax Form, 1-Part, Copy B, 100/Pack (LW2EEBQ)

Item #: 901-5202

2025 1-Part W-2 Copy B Forms for 100 employees

2025 W-2 forms must be mailed or eFiled to the SSA and furnished to your employees by February 2, 2026; IRS eFile regulations require e-Filing for 10 or more returns of certain forms; Use Adams Tax Forms Helper to eFile to the IRS/SSA

1-Part W-2 Copy B sheets

ComplyRight 2025 W-2 Tax Form, 6-Part, 2-Up, 25/Pack (5650E25)

Item #: 901-24650568

Form W-2 and transmittal Form W-3 for reporting wages and tax statements

6-Part Set Includes: Copy A, B, C, 2, D, 1 (13 Sheets each) 3 Transmittals and 25 Self-Seal Envelopes

2-Up: 2 Forms per Sheet

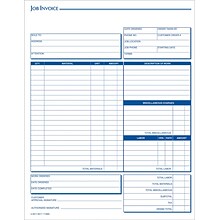

Adams® Job Invoice Form, Ruled, 8" x 11", 2-Part, White, 100 Sheets/Pack (NC2817)

Item #: 901-468769

Carbonless job invoice sets for service industries

Dimensions: 8.5" x 11.44" x 1.1"

White original to copy and white duplicate with blue text

Adams 2025 W-2 Tax Form, 1-Part, Copy 1/D, 100/Pack (LW2ERQ)

Item #: 901-5204

2025 1-Part W-2 Copy 1 or D Forms for up to 100 employees

2025 W-2 forms must be mailed or eFiled to the SSA and furnished to your employees by February 2, 2026; IRS eFile regulations require e-Filing for 10 or more returns of certain forms; Use Adams Tax Forms Helper to eFile to the IRS/SSA

1-Part W-2 Copy 1/D sheets

Adams 2025 W-2 Tax Form, 1-Part, Copy C, 100/Pack (LW2EEC2)

Item #: 901-5203

2025 1-Part W-2 Copy C or 2 Forms for up to 100 employees

2025 W-2 forms must be mailed or eFiled to the SSA and furnished to your employees by February 2, 2026; IRS eFile regulations require e-Filing for 10 or more returns of certain forms; Use Adams Tax Forms Helper to eFile to the IRS/SSA

1-Part W-2 Copy C/2 sheets

ComplyRight 2025 W-2 Tax Form Envelopes/Recipient Copy Only (No Backer), 1-Part, 4-Up, 50/Pack (5221E)

Item #: 901-24578231

W-2/1099 recipient-only tax form with envelope is designed for organizations that will be required to e-file and therefore will not need Copy A or transmittal forms 1096 or W-3

Tax form page format: 4-up

50 tax forms per pack

Adams Employee's Copies Cut Sheet 2025 W-2 Tax Form, 1-Part, Copy B, C, 2, 100/Pack (LW24UPALT100)

Item #: 901-5205

2025 4 Corner W-2 Forms for 100 employees

2025 W-2 forms must be mailed or eFiled to the SSA and furnished to your employees by February 2, 2026; IRS eFile regulations require e-Filing for 10 or more returns of certain forms; Use Adams Tax Forms Helper to eFile to the IRS/SSA

W-2 forms include Copies B, 2, C, 2 in 4 per sheet format

Adams 2025 1099-NEC Tax Form, 1-Part, 100/Pack (LNECPAY2)

Item #: 901-LNECPAY2

2025 1-Part 1099-NEC Copy 1 or 2 Forms for 150 recipients

The 2025 1099-NEC must be mailed or eFiled to the IRS and furnished to your recipients by February 2, 2026; As of 2023, IRS eFile regulations require e-Filing for 10 or more returns of certain forms; Use the new Adams Tax Forms Helper to eFile to the

IRS/SSA ...

IRS/SSA ...

ComplyRight 2025 1099-MISC Tax Form Envelopes/Recipient Copy Only, 3-Part, 25/Pack (6112E25)

Item #: 901-24578202

Recipient-only tax form with envelope designed for organizations that will be required to e-file, and therefore will not need Copy A or transmittal forms 1096 or W-3

Consists of three parts

25 tax forms with envelopes per pack

ComplyRight 2025 W-2 Tax Form, 4-Part, 4-Up, Employee Copy, 50/Pack (520650)

Item #: 901-24507930

W-2 form provides wage and income information to your employees, the SSA, the IRS, and state and local governments

4-up format : Employee Copy B, C, 2, and 2 forms (horizontal)

For laser printers

ComplyRight 2025 1099-DIV Tax Form, 1-Part, 2-Up, Federal Copy A, 50/Pack (513050)

Item #: 901-24507956

File form 1099-DIV for each person: to whom you have paid dividends (including capital gain dividends and exempt-interest dividends) and other distributions on stock of $10 or more; for whom you have withheld and paid any foreign tax on dividends and

other distributions on stock; for whom you have withheld any federal income tax on dividends under the backup withholding rules; or to whom you have paid $600 or more as part of a liquidation. ...

other distributions on stock; for whom you have withheld any federal income tax on dividends under the backup withholding rules; or to whom you have paid $600 or more as part of a liquidation. ...

Federal Copy A, 2-Up

ComplyRight 2025 1099-NEC Tax Form Recipient Copy Only, 3-Part, 3-Up, Copy B, C/2, 50/Pack (NEC6113)

Item #: 901-24578203

1099-NEC recipient-only tax form set designed for organizations that will be required to e-file, and therefore will not need Copy A or transmittal forms 1096 or W-3

Includes three-part tax forms

3-Up forms: three forms on a single sheet

ComplyRight 2025 W-2 Tax Form Envelopes/Recipient Copy Only, 1-Part, 4-Up, Copy B, C, 2 and 2 combined, 50/Pack (5205E)

Item #: 901-24578181

W-2 recipient-only tax form with envelope is designed for organizations that will be required to e-file, and therefore will not need Copy A or transmittal forms 1096 or W-3

4-up page format

Includes copies B, C, 2 and 2 combined

ComplyRight 2025 1099-MISC Tax Form Envelopes/Recipient Copy Only, 3-Part, 50/Pack (6112E)

Item #: 901-24578223

1099-MISC recipient-only blank tax form designed for organizations that will be required to e-file and therefore will not need Copy A or transmittal forms 1096 or W-3

Consists of three parts

Includes a universal blank with stub for all 1099-MISC, 1099-INT, 1099-R, 1099-DIV, and 1099-B forms

ComplyRight 2025 1094-C Tax Form, 1-Part, White/Black, 50/Pack (1094CT50)

Item #: 901-24507962

1094-C Transmittal Of Employer-Provided Health Insurance Offer And Coverage Information Returns For Form 1095C.

Pack of 50 forms

Three page form.

Adams Employee's Copies Cut Sheet 2025 W-2 Tax Form, 5-Part, 2000/Carton (LW24UPBBULK-S)

Item #: 901-920128

2025 Blank W-2 Forms have Copy B & C instructions printed on the back

2025 W-2 forms must be mailed or eFiled to the SSA and furnished to your employees by February 2, 2026; IRS eFile regulations require e-Filing for 10 or more returns of certain forms; Use Adams Tax Forms Helper to eFile to the IRS/SSA

W-2 forms include Blank Fronts with Copy B & C instructions printed on the back

ComplyRight 2025 1099-INT Tax Form, 1-Part, 2-Up, Copy A, 50/Pack (512050)

Item #: 901-24507923

File form 1099-INT, interest income, for each person: to whom you paid amounts of at least $10 (or at least $600 of interest paid in the course of your trade or business)

Federal Copy A, 2-Up

1 Page Equals 2 Forms