Page 3 of veterinary exam forms

(2989 items found)

Filter by:

Sort by:

Best match

ComplyRight 2025 1099-NEC Tax Form Envelopes/Recipient Copy Only, 2-Part, 3-Up, Copy B, C/2, 50/Pack (NEC6113E)

Item #: 901-24578213

1099-NEC recipient-only tax form designed for organizations that will be required to e-file and therefore will not need Copy A or transmittal forms 1096 or W-3

Consists of two parts

Tax form page format: 3-Up

Adams 2025 1099-NEC Tax Form Kit, 4-Part, Copy A, B, 1, 2, 50/Pack (6103NECQ)

Item #: 901-6103NECQ

2025 4-Part 1099-NEC Forms for 50 recipients and 6 1096 forms

The 2025 1099-NEC must be mailed or eFiled to the IRS and furnished to your recipients by February 2, 2026; As of 2023, IRS eFile regulations require e-Filing for 10 or more returns of certain forms; Use the new Adams Tax Forms Helper to eFile to the

IRS/SSA ...

IRS/SSA ...

ComplyRight 2025 1099-NEC Tax Form, 1-Part, 3-Up, Payer Copy C, 50/Pack (NEC511250)

Item #: 901-24507950

File form 1099-NEC for each person in the course of your business to whom you have paid during the year.

Payer Copy C, 3-Up

1 Page Equals 3 Forms

ComplyRight 2025 W-2 Tax Form Set with Self-Seal Envelopes, 4-Part, 2-Up, For 50 Employees

Item #: 901-24650565

Form W-2 and transmittal Form W-3 for reporting wages and tax statements

4-Part Set Includes: Copy A, B, C, D (25 Sheets each) 3 Transmittals and 50 Self-Seal envelopes

2-Up: 2 Forms per Sheet

ComplyRight 2025 W-2 Tax Form Envelopes/Recipient Copy Only, 1-Part, 4-Up, Copy B, C, 2 and 2 combined, 25/Pack (5205E25)

Item #: 901-24578182

W-2 recipient-only tax form with envelope is designed for organizations that will be required to e-file, and therefore will not need Copy A or transmittal forms 1096 or W-3

4-up page format

Includes copies B, C, 2 and 2 combined

ComplyRight 2025 1099-NEC Tax Form, 1-Part, 3-Up, Recipient Copy B, 50/Pack (NEC511150)

Item #: 901-24507937

File form 1099-NEC for each person in the course of your business to whom you have paid during the year.

Recipient Copy B, 3-Up

1 Page Equals 3 Forms

ComplyRight 2025 1099-K Tax Form, 1-Part, 2-Up, Copy C, 50/Pack (532725)

Item #: 901-24650548

Use the Form 1099-K for payments made in settlement of reportable payment transactions for each calendar year

2-Up: 2 Forms per Sheet

Pack of 50 forms

ComplyRight 2025 W-2 Tax Form, 3-Part, 3-Up, 50/Pack (517450)

Item #: 901-24507971

W-2 form provides wage and income information to your employees, the SSA, the IRS, and state and local governments

3-up: blank face with stub and no backer Instructions

For laser printers

ComplyRight 2025 W-2 Tax Form, 3-Part, 3-Up, 50/Pack (521150)

Item #: 901-24508152

W-2 forms provide wage and income information to your employees, the SSA, the IRS, and state and local governments

3-up (horizontal format) forms

For laser printers

TaxRight 2025 1099-MISC Tax Form Tax Form Set with Envelopes, 4-Part, 10/Pack (SC6103E10)

Item #: 901-24420225

1099-MISC (4-Part) tax form set with envelopes.

Includes (3) 1096 transmittal forms.

Features ComplyRight tips for optimal, compliant use - Covers minimum requirements, penalties, common errors and employer do's and don'ts.

TaxRight 2025 W-2 Tax Form Tax Forms, Envelopes, TipSheet & Software, 4-Part, 10/Pack (SC5645ES10)

Item #: 901-24199724

W-2 (4-Part) tax form set with software and envelopes.

Includes (3) W-3 transmittal forms.

Features ComplyRight tips for optimal, compliant use - Covers minimum requirements, penalties, common errors and employer do's and don'ts.

TaxRight 2025 W-2 Tax Form Tax Forms, Envelopes, TipSheet & Software, 6-Part, 10/Pack (SC5650ES10)

Item #: 901-24202435

W-2 (6-Part) tax form set with software and envelopes.

Includes (3) W-3 transmittal forms.

Features ComplyRight tips for optimal, compliant use - Covers minimum requirements, penalties, common errors and employer do's and don'ts.

TaxRight 2025 1099-NEC Tax Form Tax Forms, Envelopes & TipSheet, 4-Part, 50/Pack (NECSC6103E)

Item #: 901-24461402

1099-NEC (4-Part) tax form set with envelopes.

Includes (3) 1096 transmittal forms.

Features ComplyRight tips for optimal, compliant use - Covers minimum requirements, penalties, common errors and employer do's and don'ts.

TaxRight 2025 W-2 Tax Form Tax Form Set with Envelopes, 4-Part, 50/Pack (SC5645E)

Item #: 901-24420226

W-2 (4-Part) tax form set with envelopes.

Includes (3) W-3 transmittal forms.

Features ComplyRight tips for optimal, compliant use - Covers minimum requirements, penalties, common errors and employer do's and don'ts.

ComplyRight 2025 W-2 Tax Form Tax Form Set with Envelopes, 8-Part, 2-Up, 50/Pack (95218E)

Item #: 901-24431094

Form W-2 and transmittal form W-3 for reporting wages and tax statements

Pre-packaged eight-part form set includes copies A, B, C, D, 1, 2

For laser printers

Medical Arts Press® Chiropractic Registration and History Form without Updates, Sky Blue, 250 Forms/Pack (20572)

Item #: 901-20572

Forms ensure reimbursement, improve risk management and document your clinical process

Comprehensive color forms include areas for complete registration and history information, reason for visit, type of pain, site of pain or numbness

Also features areas for severity, onset, effect on daily activities, and co

$65.99

1 pack

($0.26/EACH)

Save 6%

$61.99

2+ pack

($0.25/EACH)

ComplyRight 2025 W-2 Blank Tax Form, 4-Up (Horizontal), with Backer Instructions, Pack of 500 Forms

Item #: 901-24650554

Form W-2 provides wage and income information to your employees, the SSA, the IRS, and state and local governments

Single-part, blank tax form

For laser printers

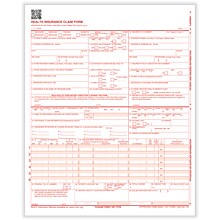

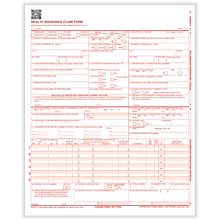

ComplyRight CMS-1500 Health Insurance Claim Forms (02/12), 8-1/2" x 11", Pack of 500 (CMS12LC500)

Item #: 901-CMS12LC500

Includes QR code identifier at the top of the form that supports and aligns with Industry scanning systems

Printed with OCR "dropout" red ink on 20lb. paper (per government regulations)

Includes new QR code identifier at the top of the form that supports and aligns with Industry scanning systems

ComplyRight CMS-1500 Health Insurance Claim Forms (02/12), 8-1/2" x 11", Box of 1,000 (CMS12LC1)

Item #: 901-CMS12LC1

Includes QR code identifier at the top of the form that supports and aligns with Industry scanning systems

Printed with OCR "dropout" red ink on 20lb. paper (per government regulations)

Includes new QR code identifier at the top of the form that supports and aligns with Industry scanning systems

ComplyRight CMS-1500 Health Insurance Claim Form, 250/Box (CMS12LC250)

Item #: 901-CMS12LC250

Approved by the National Uniform Claim Committee (NUCC); HIPAA compliant

This form was revised to align the paper form with some of the changes in the electronic healthcare claims: Professional (837), 005010X222 Technical Report Type 3 (5010) and 005010X222A1 Technical Report Type 3 (5010A1)

The most significant change was the addition of 8 diagnosis codes in field 21

TOPS Centers for Medicare and Medicaid Services Forms, 8-1/2" x 11", 250/Pack (50135RV)

Item #: 901-2408453

CMS-1500 claim forms (formerly known as HCFA-1500 claim forms) expedite Medicare, Medicaid or private insurance benefits

Top sensor bar for microfiche duplication, as required in some states

OCR red ink for scanning

ComplyRight 2025 1099-NEC Tax Form Self-seal envelopes, 3-Part, 3-Up, Copy A, B, C/2, 1096 Transmittal, 100/Pack (NEC6102E100)

Item #: 901-24578219

1099-NEC tax form is created for companies to report payments made to an individual who performed services in the course of business as a nonemployee

Consists of three parts

Tax form page format: 3-Up

ComplyRight 2025 1099-NEC Tax Form Envelopes, 4-Part, 3-Up, Copy A, B, C/2, 1096 Transmittal, 100/Pack (NEC6103E100)

Item #: 901-24578201

1099-NEC tax form set is created for companies to report payments made to an individual who performed services in the course of business as a nonemployee

Consists of four parts

3-up page format: three forms on a single sheet

Adams 2025 1099-R Tax Forms Kit, 5-Part, 2-Up, 10/Pack (STAX5R-25)

Item #: 901-24639767

2025 1099-R kit includes 10 5-part 1099-Rs and access to Adams Tax Forms Helper

For paper filers, the 2025 1099-R (copies B, C and 2) are due to your recipients by February 2, 2026; Copy A and 1096 are due to the IRS by March 2, 2026; eFile by March 31, 2026

1099-R forms are 5-part