Page 5 of veterinary exam forms

(2989 items found)

Filter by:

Sort by:

Best match

ComplyRight 2025 1099 Tax Form, 2-Part, 2-Up, 50/Pack (514450)

Item #: 901-24507955

Use this universal 1099 blank tax form to file a 1099-MISC, 1099-INT, 1099-R, 1099-DIV, or 1099-B

2-up form contains stub

For laser printers

ComplyRight 2025 W-2 Tax Form, Employee’s Copies B, C, 2 & 2 Combined, 4-Up, 25/Pack (520525)

Item #: 901-24650545

Copies B, C, 2 & 2 Combined

4-Up (Box)

Pack of 25 Forms

Adams Employee's Copies Cut Sheet 2025 Blank W-2 Tax Form, 4-Part, 50/Pack (BL1099-S)

Item #: 901-920002

Blank forms can be used for W-2 or 1099 tax forms

3-down style with perforations

Blank front and back

ComplyRight 2025 1099-NEC Tax Form, 4-Part, 3-Up, Copy A, B, C/2, 1096 Transmittal, 100/Pack (NEC6103100)

Item #: 901-24578197

1099-NEC (nonemployee compensation) is an IRS form created for companies to report payments made to an individual who performed services in the course of business as a nonemployee

Includes four-part tax forms

3-Up forms: three forms on a single sheet

ComplyRight 2025 1099-NEC Recipient Copy Only Tax Form, Envelopes and LaserLink Software, 3-Part, 3-Up, White, 50/Pack

Item #: 901-24614850

1099-NEC Blank Tax Form, No Backer (50), Self-Seal Envelopes (50) and LaserLink Software – 1 Page Equals 3 Forms

Includes LaserLink software: A simple, efficient desktop software application for preparing 1099s and W-2s. Backed by reliable, Windows-based functionality, this software provides the features you need to print or e-file your 1099 and W-2 forms.

Pack of 50

ComplyRight 2025 W-2 Tax Form, 2-Part, 2-Up, Employee Copy C, 50/Pack (520350)

Item #: 901-24507933

W-2 form provides wage and income information to your employees, the SSA, the IRS, and state and local governments

2-up: Employee Copy C and/or State, City, or Local Copy 2

For laser printers

ComplyRight 2025 W-2 Tax Form, 1-Part, 3-Up, Employee Copy B, C, and 2, 50/Pack (521050)

Item #: 901-24507947

Form W-2 provides wage and income information to your employees, the SSA, the IRS, and state and local governments

Single-part, 3-up (horizontal): Employee Copies B, C, and 2 combined

For laser printers

ComplyRight 2025 W-2C Tax Form, 1-Part, Employee Copy B, 50/Pack (531450)

Item #: 901-24507952

W-2C tax form is used to correct errors on forms W-2, W-2AS, W-2CM, W-2GU, W-2VI, or W-2c filed with the SSA

Single-part: Employee Copy B

For laser printers

ComplyRight 2025 1095-C Tax Form, 1-Part, White/Black, 50/Pack (1095CIRS50)

Item #: 901-24507913

Form 1095-C to report the information required under sections 6055 and 6056 about offers of health coverage and enrollment in health coverage for employees

Consists of two parts

For laser printers

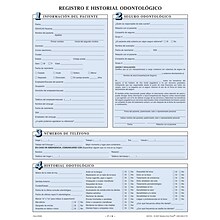

Medical Arts Press Dental Registration Forms Featuring Updates Section; Sky Blue, Spanish (20743)

Item #: 901-20743

Collects printed name and relationship to patient

Medication list requests correlating diagnosis

Screens for artificial heart valves, artificial joints, heart

ComplyRight 2025 1095-C Tax Form, 1-Part, White/Black, 25/Pack (1095CIRSC25)

Item #: 901-24507963

1095-C continuation form is used to report the information required under sections 6055 and 6056 about offers of health coverage and enrollment in health coverage for their employees

Consists of two parts

For laser printers

ComplyRight 2025 W-2 Tax Form, 1-Part, 2-Up, Employee Copy B, 50/Pack (520250)

Item #: 901-24507925

W-2 form provides wage and income information to your employees, the SSA, the IRS, and state and local governments

Single-part, 2-up : Employee IRS Federal Copy B

For laser printers

ComplyRight 2025 1099-R Tax Form, 1-Part, 2-Up, Payer Copy D, 50/Pack (514350)

Item #: 901-24507924

File form 1099-R for each person to whom you have made a distribution of $10 or more from profit-sharing or retirement plans, any individual retirement arrangements (IRAs), annuities, and more

Payer Copy D and/or State, City, or Local, 2-Up

1 Page Equals 2 Forms

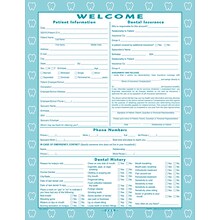

Medical Arts Press® Dental Registration and History Form; Tooth Border, 250 Sheets/Pack (20596)

Item #: 901-20596

HIPAA compliant insurance authorization

Help ensure reimbursement and improve risk management

Collects printed name and relationship to patient

ComplyRight 2025 1095-C Tax Form, 1-Part, White/Black, 25/Pack (1095CIRS25)

Item #: 901-24507922

1095-C tax form

Single-part

For laser printers

ComplyRight 2025 1095-C Tax Form, 1-Part, 500/Pack (1095C500)

Item #: 901-24507953

1095-C tax form

Single-part

Laser printer compatible

ComplyRight 2025 Double-Window Envelopes For 1099-R Tax Forms, 4-Up Box, Self-Seal, Pack Of 100

Item #: 901-24650541

Double-window envelope accommodates 4-Up 1099-R (5175) forms.

Features a self-seal flap.

Pack of 100 envelopes.

ComplyRight 2025 W-2 Tax Form Envelopes/Recipient Copy Only, 5-Part, 2-Up, Copy B, C/2, D/1, 25/Pack (5648E25)

Item #: 901-24578230

Recipient-only tax form with envelope is designed for organizations that will be required to e-file and therefore will not need Copy A or transmittal forms 1096 or W-3

Consists of five parts

2-up format: one sheet equals two forms

ComplyRight 2025 1099-MISC Tax Form, 3-Part, 2-Up, 50/Pack (6102E)

Item #: 901-24650569

3-Part Set: Copy A, B, State/File (25 sheets each), transmittals (3) and Self-Seal Envelopes (50)

2-Up: 2 Forms per Sheet

For 50 Employees

ComplyRight 2025 1099-K Tax Form, 1-Part, 2-Up, 50/Pack (532625)

Item #: 901-24650547

Use the Form 1099-K for payments made in settlement of reportable payment transactions for each calendar year

2-Up: 2 Forms per Sheet

Pack of 50 forms

ComplyRight 2025 1099-K Tax Form, 1-Part, 2-Up, Copy A, 50/Pack (532525)

Item #: 901-24650546

Use the Form 1099-K for payments made in settlement of reportable payment transactions for each calendar year

2-Up: 2 Forms per Sheet

Pack of 50 forms

ComplyRight 2025 1099-R Tax Form, 1-Part, 2-Up, Recipient Copy B, 50/Pack (514150)

Item #: 901-24507943

File form 1099-R for each person to whom you have made a distribution of $10 or more from profit-sharing or retirement plans, any individual retirement arrangements (IRAs), annuities, and more

Recipient Copy B, 2-Up

1 Page Equals 2 Forms

ComplyRight 2025 W-2 Tax Form, 4-Part, 4-Up, 50/Pack (522150)

Item #: 901-24507919

W-2/1099-R form provides wage and income information to your employees, the SSA, the IRS, and state and local governments

4-Up, 4 Corner W-2 and 1099-R blank, no backer

For laser printers

Adams Employee's Copies Cut Sheet 2025 Blank W-2 Tax Form, 1-Part, 2-Up, 100/Pack (BLW2Q)

Item #: 901-5207

2025 Blank W-2 Forms for up to 100 employees

2025 W-2 forms must be mailed or eFiled to the SSA and furnished to your employees by February 2, 2026; IRS eFile regulations require e-Filing for 10 or more returns of certain forms; Use Adams Tax Forms Helper to eFile to the IRS/SSA

Blank W-2 forms with blank backers