Page 13 of proposal 8 1 2x11 carbonless triplicate 50 loose form sets

(3010 items found) Please choose at least 2 items to compare

Filter by:

Category

Tax Forms (158)

Accounting & Record Journals (93)

Business Forms (126)

HR Forms (231)

Custom Charge Slips (118)

Custom Service and Appointment Forms (82)

Copy & Printer Paper (64)

Custom General Medical (51)

Medical Forms (40)

Custom Design Your Own Custom Forms (10)

Custom Dentistry (9)

Custom Veterinary (8)

All Desktop Computers (234)

Cell Phone Cases (173)

Custom Laser Middle Checks (122)

Custom Laser Top Checks (121)

Stage Equipment (101)

Work Gloves (70)

Storage Containers & Boxes (65)

Tablet & iPad Cases, Covers & Keyboards (64)

Sit & Stand Desks (60)

Headphones (49)

Laptop Sleeves & Cases (40)

Custom Deposit Slips (33)

Cardstock (32)

Custom Invoice (30)

Custom Laser High Security Middle Checks (30)

Tax Envelopes (29)

Custom Laser 3-On-A-Page Checks (24)

Floor Lamps (24)

Custom Manual 3-On-A-Page Checks (22)

Custom Receipt Books (21)

Office Desks (21)

POS Computers & Accessories (21)

Planners & Personal Organizers (20)

Clipboards (19)

GPS Accessories (15)

STEM Toys & Manipulatives (14)

Cubicle & Panel Workstations (13)

Custom Continuous Top Checks (13)

Custom Bill of Lading (12)

Custom Laser High Security 3-On-A-Page Checks (12)

Literature & Mail Sorters (11)

Sketch Pads & Books (11)

Custom Laser Bottom Checks (10)

Internal Hard Drives (10)

Business Envelopes (9)

Computer Keyboards (9)

Art Brushes (8)

Custom Continuous Bottom Checks (8)

File Folder Sorters & Accessories (8)

Graphing Calculators (8)

Liquid & Powdered Drink Mixes (8)

Craft Kits (7)

Desk Lamps (7)

Display Boards (7)

Ethernet Switches (7)

Firewall Devices (7)

Paint (7)

Craft Supplies (6)

Custom Continuous Center Checks (6)

Custom Purchase Order (6)

File Storage Boxes (6)

Glue & Glue Sticks (6)

Notepads (6)

Pet Containment (6)

Shipping Boxes (6)

USB Hubs (6)

Webcams (6)

Adapters & Splitters (5)

Cell Phone Mounts & Holders (5)

Custom Packing List (5)

Custom Snap Apart Sales Slips (5)

Dot Matrix Printers (5)

Hard Drive Enclosures (5)

Labels (5)

Lubricants (5)

Paper Folding Machines & Joggers (5)

Printer Accessories & Replacement Parts (5)

Security & Carbon Paper (5)

Smart Bulbs (5)

Carts & Stands (4)

Classroom Posters & Charts (4)

Cleaning Chemicals (4)

Computer Monitors (4)

Custom Manual 1-To-A-Page Checks (4)

Fall Protection Kits, Parts & Accessories (4)

Laptop Docking Stations (4)

Laundry Detergent (4)

Literacy & Language Arts Books (4)

Memory Cards (4)

Solid State Drives (4)

Surge Protectors & Power Strips (4)

Teacher Resources & Aids (4)

Tower Computer Cases (4)

Cameras & Camcorders (3)

Disc Drives & Burners (3)

Dish Soap (3)

Flash Cards (3)

Hand Soap (3)

Ice Makers & Snow Cone Machines (3)

Keyboard & Mouse Combos (3)

Maps & Globes (3)

Network Adapters (3)

Power Supplies (3)

Rehabilitation & Therapeutic Equipment (3)

Rope, String & Twine (3)

Sofas, Loveseats & Sectionals (3)

Storage Drawers (3)

Accounting Software (2)

Barcode Scanners & Readers (2)

Battery Backup & UPS (2)

Borders & Trims (2)

Calendars (2)

Classroom Paper (2)

Computer Mice (2)

Crayons (2)

Custom CMS Forms (2)

Custom Giveaways (2)

Custom Manual High Security 3 on a Page Checks (2)

File Cabinets (2)

Fitness Accessories (2)

Headsets (2)

Laptop Chargers & Adapters (2)

Learning Games & Puzzles (2)

Mannequins (2)

Medical Labeling (2)

Medical Labels and Tab Protectors (2)

Modems (2)

Multi-Copy General (2)

Name Plates & Name Tags (2)

Network Transceivers (2)

Phone Accessories (2)

Portable Speakers & Radios (2)

Premiums (2)

Pretend Play Toys & Dolls (2)

Reaching & Extending Aids (2)

Retail Displays (2)

Single-Copy Dental (2)

Spill Containment & Sorbents (2)

Storage Cabinets (2)

Tampons (2)

Tax Software (2)

Video Capture Devices (2)

Wall Files (2)

Antacids (1)

Anti-Seize Compounds (1)

Antiseptics (1)

Art Paper & Rolls (1)

Baby Skin Care (1)

Board & Card Games (1)

Bookcases & Bookshelves (1)

Bookends (1)

Bulletin Boards (1)

Cables (1)

Camera & Camcorder Accessories (1)

Cash Handling (1)

Chair Parts & Accessories (1)

Chargers & Charging Cables (1)

Clothing Hangers & Accessories (1)

Coffee (1)

Construction Paper (1)

Custom Chiropractic (1)

Custom Full Color 2-Sided, Ultra Thick, Flat Print Business Card (1)

Custom Holiday Cards (1)

Custom Plastic and Stick Pens (1)

Custom Podiatry (1)

Custom Sports & Water Bottles (1)

Custom Tumblers (1)

Disposable Gloves (1)

Drafting Chairs & Office Stools (1)

Dress Forms (1)

Easels (1)

Electrodes & TENs Units (1)

Electronic Cleaning & Maintenance (1)

File Folders (1)

Flooring Accessories (1)

Gaming Controllers (1)

Gauze Pads & Sponges (1)

Grooming & Dressing Aids (1)

Hand Lotion (1)

Hard Drive Accessories (1)

Hard Hat & Safety Helmet Accessories (1)

Hard Hats & Safety Helmets (1)

Household Flatware & Cutlery (1)

Ice Melt (1)

Ink & Toner (1)

Invitation Envelopes (1)

KVM Cables & Switches (1)

Labor Law Posters (1)

Landline Phones (1)

Laptop Stands & Lap Desks (1)

Lesson Plans & Grade Books (1)

Letters & Numbers (1)

Lubricating Jelly (1)

Mailboxes (1)

Masking Tape (1)

Medical Charting (1)

Medical Coding & Billing (1)

Medical File Organization (1)

Brand

Quill Brand (19)

Staples (19)

3M (2)

2000 Plus (1)

ACCO (1)

Acer (1)

Activa (1)

Adams (83)

Adesso (8)

AdirOffice (1)

Alliance (3)

Ambitex (1)

Ameriwood (1)

Ampad (1)

APC (1)

Apple (4)

Appleton NCR (1)

Appvion (1)

Arf Pets (6)

Assorted Publishers (1)

Asus (1)

Avery (5)

Axis (1)

Azar (3)

Bankers Box® (9)

Bazic (2)

Beats (1)

Beistle (1)

Belkin (7)

Best Manufacturing (1)

Better Office (5)

Blanks USA (4)

Blueline (1)

Boorum & Pease (7)

Bouncy Bands (3)

Bower (1)

Brady (2)

Brainboxes (2)

Burt's Bees (1)

Bush Business Furniture (87)

Bush Furniture (1)

Bush Home (7)

C-Line (3)

Cando (3)

Canon (1)

Canson (11)

Cardinal (1)

Cascade (1)

Case Logic (2)

Casio (3)

Centon (2)

Cherry (1)

Cisco (5)

Clever Fox (2)

CODi (2)

ComplyRight (395)

Corwin (1)

Cosco (8)

Craftex (1)

Crayola (7)

Creative Shapes (1)

Creative Teaching (2)

Cyber Acoustics (1)

Daler-Rowney (2)

DAS (1)

DataProducts (2)

Delforms (2)

Dell (102)

Deluxe (667)

Desitin (1)

Didax (1)

Dixon (4)

Dome (5)

DPI (1)

Drano (1)

Eaton (1)

Ennis (18)

EPE USA (1)

Epson (5)

Ergodyne (14)

Esselte (8)

Eureka (1)

Evan-Moor (4)

FabLife (3)

Fellowes (6)

First Aid Only (1)

Flipside (5)

Folgers (1)

FolkArt (1)

Formax (1)

Furman (1)

Garmin (1)

Gatorade (6)

Gibson (1)

Global Printed Products (3)

Glove Crafter (1)

GN Netcom (1)

Gofit (2)

GOJO (2)

Golden (1)

Gorilla (2)

Hamilton Buhl (3)

Hammermill (8)

Headu (1)

HON (2)

Honeywell (9)

Honeywell North (1)

HP (81)

HPE (5)

Hygloss (1)

Icy Dock (1)

Igloo (3)

Ingram (1)

Intuit (1)

jabra (4)

JAM Paper (53)

Joy (2)

Juniper (2)

Kagan (1)

Kensington (1)

Koss (1)

Kum (1)

Learning Advantage (1)

Learning Resources (1)

Lencca (1)

Lenovo (49)

Lexmark (2)

Logitech (11)

Lorell (2)

LUX (8)

Luxor (2)

Mattel (1)

MAX CASES (1)

Maxell (1)

MBM (4)

Medical Arts Press (38)

Medline (1)

Melissa & Doug (1)

Merriam-Webster (1)

Mind Reader (3)

Monarch Specialties Inc. (1)

Mount-It! (1)

MSI (13)

Nahanco (3)

National Brand (11)

National Geographic (2)

National Public Seating (101)

Nekoosa (2)

OtterBox (4)

Partners Brand (3)

Pebeo (2)

Permatex (2)

Philips (5)

Plugable (2)

PM Company (5)

Polaroid (3)

Printworks Professional (10)

ProFlex by Ergodyne (60)

Quantum Storage Systems (65)

Quill Custom Print (109)

Rediform (27)

Romanoff Products (2)

Roylco (3)

Safco (3)

SAHARACASE (294)

SanDisk (4)

Saunders (9)

SI Products (5)

Silver Brush (7)

Simple Designs (30)

Simple Green (2)

Smead (2)

Sonicwall (6)

Sony (2)

Southwest School Supply (2)

Sqwincher (2)

StarTech (13)

SUPCASE (3)

Super Lube (4)

Tabbies (3)

Tampax (2)

Targus (2)

Teacher Created Resources (12)

Tenikle (5)

Tennsco (5)

Texas Instruments (5)

TFP (4)

Thermaltake (5)

Tide (4)

TOPS (50)

Tripp Lite (3)

Ubiquiti (2)

Vangoddy (15)

ViewSonic (4)

Western Digital (8)

Willow Creek (21)

Wilson Jones (10)

Xerox (5)

YeaLink (2)

Zebra (13)

Product ratings

and up

(544)

and up

(628)

and up

(660)

Form type

Agreements (14)

Design Your Own (8)

Pet Health (5)

Clinical (4)

Laser Checks (264)

1-Color (229)

Standard (161)

2-Color (141)

Premium (117)

High Security Checks (63)

No (40)

Blank Check Stocks (36)

Deposit Slips (31)

Documentation (31)

Continuous Checks (26)

Business Checks (22)

Billing (18)

Prescription Pads (8)

Insurance (7)

Charge Slip (6)

Referral (6)

Medicare (2)

Sales (2)

Physical (1)

Customizable

Yes (755)

Sort by:

Best match

Back

-

Tax Forms (158) -

Accounting & Record Journals (93) -

Business Forms (126) -

HR Forms (231) -

Custom Charge Slips (118) -

Custom Service and Appointment Forms (82) -

Copy & Printer Paper (64) -

Custom General Medical (51) -

Medical Forms (40) -

Custom Design Your Own Custom Forms (10) -

Custom Dentistry (9) -

Custom Veterinary (8) -

All Desktop Computers (234) -

Cell Phone Cases (173) -

Custom Laser Middle Checks (122) -

Custom Laser Top Checks (121) -

Stage Equipment (101) -

Work Gloves (70) -

Storage Containers & Boxes (65) -

Tablet & iPad Cases, Covers & Keyboards (64) -

Sit & Stand Desks (60) -

Headphones (49) -

Laptop Sleeves & Cases (40) -

Custom Deposit Slips (33) -

Cardstock (32) -

Custom Invoice (30) -

Custom Laser High Security Middle Checks (30) -

Tax Envelopes (29) -

Custom Laser 3-On-A-Page Checks (24) -

Floor Lamps (24) -

Custom Manual 3-On-A-Page Checks (22) -

Custom Receipt Books (21) -

Office Desks (21) -

POS Computers & Accessories (21) -

Planners & Personal Organizers (20) -

Clipboards (19) -

GPS Accessories (15) -

STEM Toys & Manipulatives (14) -

Cubicle & Panel Workstations (13) -

Custom Continuous Top Checks (13) -

Custom Bill of Lading (12) -

Custom Laser High Security 3-On-A-Page Checks (12) -

Literature & Mail Sorters (11) -

Sketch Pads & Books (11) -

Custom Laser Bottom Checks (10) -

Internal Hard Drives (10) -

Business Envelopes (9) -

Computer Keyboards (9) -

Art Brushes (8) -

Custom Continuous Bottom Checks (8) -

File Folder Sorters & Accessories (8) -

Graphing Calculators (8) -

Liquid & Powdered Drink Mixes (8) -

Craft Kits (7) -

Desk Lamps (7) -

Display Boards (7) -

Ethernet Switches (7) -

Firewall Devices (7) -

Paint (7) -

Craft Supplies (6) -

Custom Continuous Center Checks (6) -

Custom Purchase Order (6) -

File Storage Boxes (6) -

Glue & Glue Sticks (6) -

Notepads (6) -

Pet Containment (6) -

Shipping Boxes (6) -

USB Hubs (6) -

Webcams (6) -

Adapters & Splitters (5) -

Cell Phone Mounts & Holders (5) -

Custom Packing List (5) -

Custom Snap Apart Sales Slips (5) -

Dot Matrix Printers (5) -

Hard Drive Enclosures (5) -

Labels (5) -

Lubricants (5) -

Paper Folding Machines & Joggers (5) -

Printer Accessories & Replacement Parts (5) -

Security & Carbon Paper (5) -

Smart Bulbs (5) -

Carts & Stands (4) -

Classroom Posters & Charts (4) -

Cleaning Chemicals (4) -

Computer Monitors (4) -

Custom Manual 1-To-A-Page Checks (4) -

Fall Protection Kits, Parts & Accessories (4) -

Laptop Docking Stations (4) -

Laundry Detergent (4) -

Literacy & Language Arts Books (4) -

Memory Cards (4) -

Solid State Drives (4) -

Surge Protectors & Power Strips (4) -

Teacher Resources & Aids (4) -

Tower Computer Cases (4) -

Cameras & Camcorders (3) -

Disc Drives & Burners (3) -

Dish Soap (3) -

Flash Cards (3) -

Hand Soap (3) -

Ice Makers & Snow Cone Machines (3) -

Keyboard & Mouse Combos (3) -

Maps & Globes (3) -

Network Adapters (3) -

Power Supplies (3) -

Rehabilitation & Therapeutic Equipment (3) -

Rope, String & Twine (3) -

Sofas, Loveseats & Sectionals (3) -

Storage Drawers (3) -

Accounting Software (2) -

Barcode Scanners & Readers (2) -

Battery Backup & UPS (2) -

Borders & Trims (2) -

Calendars (2) -

Classroom Paper (2) -

Computer Mice (2) -

Crayons (2) -

Custom CMS Forms (2) -

Custom Giveaways (2) -

Custom Manual High Security 3 on a Page Checks (2) -

File Cabinets (2) -

Fitness Accessories (2) -

Headsets (2) -

Laptop Chargers & Adapters (2) -

Learning Games & Puzzles (2) -

Mannequins (2) -

Medical Labeling (2) -

Medical Labels and Tab Protectors (2) -

Modems (2) -

Multi-Copy General (2) -

Name Plates & Name Tags (2) -

Network Transceivers (2) -

Phone Accessories (2) -

Portable Speakers & Radios (2) -

Premiums (2) -

Pretend Play Toys & Dolls (2) -

Reaching & Extending Aids (2) -

Retail Displays (2) -

Single-Copy Dental (2) -

Spill Containment & Sorbents (2) -

Storage Cabinets (2) -

Tampons (2) -

Tax Software (2) -

Video Capture Devices (2) -

Wall Files (2) -

Antacids (1) -

Anti-Seize Compounds (1) -

Antiseptics (1) -

Art Paper & Rolls (1) -

Baby Skin Care (1) -

Board & Card Games (1) -

Bookcases & Bookshelves (1) -

Bookends (1) -

Bulletin Boards (1) -

Cables (1) -

Camera & Camcorder Accessories (1) -

Cash Handling (1) -

Chair Parts & Accessories (1) -

Chargers & Charging Cables (1) -

Clothing Hangers & Accessories (1) -

Coffee (1) -

Construction Paper (1) -

Custom Chiropractic (1) -

Custom Full Color 2-Sided, Ultra Thick, Flat Print Business Card (1) -

Custom Holiday Cards (1) -

Custom Plastic and Stick Pens (1) -

Custom Podiatry (1) -

Custom Sports & Water Bottles (1) -

Custom Tumblers (1) -

Disposable Gloves (1) -

Drafting Chairs & Office Stools (1) -

Dress Forms (1) -

Easels (1) -

Electrodes & TENs Units (1) -

Electronic Cleaning & Maintenance (1) -

File Folders (1) -

Flooring Accessories (1) -

Gaming Controllers (1) -

Gauze Pads & Sponges (1) -

Grooming & Dressing Aids (1) -

Hand Lotion (1) -

Hard Drive Accessories (1) -

Hard Hat & Safety Helmet Accessories (1) -

Hard Hats & Safety Helmets (1) -

Household Flatware & Cutlery (1) -

Ice Melt (1) -

Ink & Toner (1) -

Invitation Envelopes (1) -

KVM Cables & Switches (1) -

Labor Law Posters (1) -

Landline Phones (1) -

Laptop Stands & Lap Desks (1) -

Lesson Plans & Grade Books (1) -

Letters & Numbers (1) -

Lubricating Jelly (1) -

Mailboxes (1) -

Masking Tape (1) -

Medical Charting (1) -

Medical Coding & Billing (1) -

Medical File Organization (1)

Category

-

Quill Brand (19) -

Staples (19) -

3M (2) -

2000 Plus (1) -

ACCO (1) -

Acer (1) -

Activa (1) -

Adams (83) -

Adesso (8) -

AdirOffice (1) -

Alliance (3) -

Ambitex (1) -

Ameriwood (1) -

Ampad (1) -

APC (1) -

Apple (4) -

Appleton NCR (1) -

Appvion (1) -

Arf Pets (6) -

Assorted Publishers (1) -

Asus (1) -

Avery (5) -

Axis (1) -

Azar (3) -

Bankers Box® (9) -

Bazic (2) -

Beats (1) -

Beistle (1) -

Belkin (7) -

Best Manufacturing (1) -

Better Office (5) -

Blanks USA (4) -

Blueline (1) -

Boorum & Pease (7) -

Bouncy Bands (3) -

Bower (1) -

Brady (2) -

Brainboxes (2) -

Burt's Bees (1) -

Bush Business Furniture (87) -

Bush Furniture (1) -

Bush Home (7) -

C-Line (3) -

Cando (3) -

Canon (1) -

Canson (11) -

Cardinal (1) -

Cascade (1) -

Case Logic (2) -

Casio (3) -

Centon (2) -

Cherry (1) -

Cisco (5) -

Clever Fox (2) -

CODi (2) -

ComplyRight (395) -

Corwin (1) -

Cosco (8) -

Craftex (1) -

Crayola (7) -

Creative Shapes (1) -

Creative Teaching (2) -

Cyber Acoustics (1) -

Daler-Rowney (2) -

DAS (1) -

DataProducts (2) -

Delforms (2) -

Dell (102) -

Deluxe (667) -

Desitin (1) -

Didax (1) -

Dixon (4) -

Dome (5) -

DPI (1) -

Drano (1) -

Eaton (1) -

Ennis (18) -

EPE USA (1) -

Epson (5) -

Ergodyne (14) -

Esselte (8) -

Eureka (1) -

Evan-Moor (4) -

FabLife (3) -

Fellowes (6) -

First Aid Only (1) -

Flipside (5) -

Folgers (1) -

FolkArt (1) -

Formax (1) -

Furman (1) -

Garmin (1) -

Gatorade (6) -

Gibson (1) -

Global Printed Products (3) -

Glove Crafter (1) -

GN Netcom (1) -

Gofit (2) -

GOJO (2) -

Golden (1) -

Gorilla (2) -

Hamilton Buhl (3) -

Hammermill (8) -

Headu (1) -

HON (2) -

Honeywell (9) -

Honeywell North (1) -

HP (81) -

HPE (5) -

Hygloss (1) -

Icy Dock (1) -

Igloo (3) -

Ingram (1) -

Intuit (1) -

jabra (4) -

JAM Paper (53) -

Joy (2) -

Juniper (2) -

Kagan (1) -

Kensington (1) -

Koss (1) -

Kum (1) -

Learning Advantage (1) -

Learning Resources (1) -

Lencca (1) -

Lenovo (49) -

Lexmark (2) -

Logitech (11) -

Lorell (2) -

LUX (8) -

Luxor (2) -

Mattel (1) -

MAX CASES (1) -

Maxell (1) -

MBM (4) -

Medical Arts Press (38) -

Medline (1) -

Melissa & Doug (1) -

Merriam-Webster (1) -

Mind Reader (3) -

Monarch Specialties Inc. (1) -

Mount-It! (1) -

MSI (13) -

Nahanco (3) -

National Brand (11) -

National Geographic (2) -

National Public Seating (101) -

Nekoosa (2) -

OtterBox (4) -

Partners Brand (3) -

Pebeo (2) -

Permatex (2) -

Philips (5) -

Plugable (2) -

PM Company (5) -

Polaroid (3) -

Printworks Professional (10) -

ProFlex by Ergodyne (60) -

Quantum Storage Systems (65) -

Quill Custom Print (109) -

Rediform (27) -

Romanoff Products (2) -

Roylco (3) -

Safco (3) -

SAHARACASE (294) -

SanDisk (4) -

Saunders (9) -

SI Products (5) -

Silver Brush (7) -

Simple Designs (30) -

Simple Green (2) -

Smead (2) -

Sonicwall (6) -

Sony (2) -

Southwest School Supply (2) -

Sqwincher (2) -

StarTech (13) -

SUPCASE (3) -

Super Lube (4) -

Tabbies (3) -

Tampax (2) -

Targus (2) -

Teacher Created Resources (12) -

Tenikle (5) -

Tennsco (5) -

Texas Instruments (5) -

TFP (4) -

Thermaltake (5) -

Tide (4) -

TOPS (50) -

Tripp Lite (3) -

Ubiquiti (2) -

Vangoddy (15) -

ViewSonic (4) -

Western Digital (8) -

Willow Creek (21) -

Wilson Jones (10) -

Xerox (5) -

YeaLink (2) -

Zebra (13)

Brand

-

and up (544) -

and up (628) -

and up (660)

Product ratings

-

Agreements (14) -

Design Your Own (8) -

Pet Health (5) -

Clinical (4) -

Laser Checks (264) -

1-Color (229) -

Standard (161) -

2-Color (141) -

Premium (117) -

High Security Checks (63) -

No (40) -

Blank Check Stocks (36) -

Deposit Slips (31) -

Documentation (31) -

Continuous Checks (26) -

Business Checks (22) -

Billing (18) -

Prescription Pads (8) -

Insurance (7) -

Charge Slip (6) -

Referral (6) -

Medicare (2) -

Sales (2) -

Physical (1)

Form type

-

Yes (755)

Customizable

-

$0 - $10 (107) -

$10 - $20 (184) -

$20 - $30 (296) -

$30 - $40 (305) -

$40 - $50 (187) -

$50 - $60 (131) -

$60 - $70 (102) -

$70 - $80 (108) -

$80 - $90 (67) -

$90 - $100 (85) -

$100 - $150 (455) -

$150 - $200 (268) -

$200 - $300 (218) -

$300 - $400 (91) -

$400 - $500 (33) -

$500 - $750 (51) -

$750 - $1000 (84) -

$1000 - $1250 (60) -

$1250 - $1500 (35) -

$1500 - $1750 (39) -

$1750 - $2000 (16) -

$2000 - $2500 (14) -

$2500 - $3000 (13) -

$3000 - $4000 (11) -

$4000 - $5000 (11) -

$5000+ (40)

Price

-

Multicolor (47) -

White (133) -

Black (123) -

Gray/Silver (77) -

Green (60) -

Blue (53) -

Yellow (40) -

Red (33) -

Pink (24) -

Brown (17) -

Ivory (14) -

Purple (13) -

Assorted (10) -

Manila (10) -

Clear (9) -

Orange (7) -

Rose Gold (7) -

Beige (4) -

Gold (2) -

Grey (1)

Color family

-

Digital (8) -

Medical Authorization Form (7) -

Pet Health Record (6) -

Dental Registration Form (2) -

Middle Check (148) -

Top Check (97) -

Horizontal (91) -

3-Up Check (60) -

Medical Chart (34) -

Single Sheet (15) -

Money & Rent Receipt Books (12) -

Bottom Check (10) -

Prescription (8) -

Carbonless Sales (5) -

Service (3) -

Statement (3) -

Medical Complaint Form (2) -

Sales Book (2) -

Dental Treatment Consent Form (1) -

Dental Treatment Notes Form (1) -

HIPPA Reference Guide (1) -

Medical Superbill (1) -

Sign In Sheet (1)

Format

-

Pack (167) -

Each (226) -

Carton (4) -

Bundle (2) -

Bag (1) -

Set (1)

Selling quantity (uom)

-

500 (210) -

50 (59) -

1 (7) -

1000 (4) -

4 (2) -

250 (46) -

200 (5) -

10 (3) -

100 (3) -

15 (2) -

31 (2) -

12 (1) -

400 (1)

Business forms pack size

-

Sales, Invoices & Purchasing (225) -

Contractor & Property Management (12) -

Shipping & Receiving (10) -

Work Orders (42) -

Auto Repairs (14) -

Receipts & Guest Checks (13) -

Bill of Lading (12) -

Receipts (6) -

Packing Slips (5) -

Sales, Invoices & Purchases (1)

Business form

-

Buy more & save! (988) -

Subscribe! (282) -

Price Drop (595) -

Sale (378) -

Free Gift and Value Bundles (1)

More ways to save

-

Best Sellers (1334) -

Refurbished (148) -

Recycled (62) -

Remanufactured (1)

More ways to shop

-

8N515S12-POWER-STRIP (1) -

9PX (1) -

13 Columns (1) -

21 Series (1) -

38 Series (1) -

90 DesignJet (1) -

429-AAOX (1) -

805 G9 (1) -

1602 1/2 Series (1) -

2024-2025 Academic (1) -

2024-2025 Fiscal (1) -

2026 (1) -

3142 (3) -

3145 (1) -

7000 (10) -

7024 (10) -

7030 (10) -

7041 (5) -

7070 (10) -

7141 (10) -

Account Pro (1) -

Accounting (1) -

Adams Message Pad (1) -

Air-Dry (1) -

Anti-Roll (1) -

Anti-Seize (1) -

Aquafine (1) -

Art of the Mushroom (1) -

Artist Series (2) -

Assemble Collection (3) -

Atom (1) -

Attendance Tracking Kit (1) -

AUD010fqBL (1) -

Autoseal (1) -

Betty Boop (1) -

Bi-Fold Folio (2) -

BIZ 2300 USB UC Mono (1) -

Black (1) -

BladeSystem c-Class (1) -

Blue SA510 (1) -

Brigade (1) -

Bristlon (1) -

Bubbalux (1) -

Business Expense (1) -

Cardinals (1) -

Catalyst (5) -

Catalyst 9300 (1) -

Cats by Gary Patterson (1) -

Celestial (1) -

Centers for Medicare and Medicaid Services (1) -

Chill-Its® (2) -

Citrus (2) -

Citrus Ginger Foam Hand & Showerwash (1) -

CK67 (2) -

CK67 Series (2) -

CMS-1500 (3) -

Cms-1500 (1) -

Coffee Machine Cleaner Tablets (1) -

Commuter Series (1) -

Compaq Elite (6) -

Compaq Elite 8000 (1) -

Compaq Elite 8300 (1) -

ComplyRight (15) -

Confidential Sign-In Forms (4) -

Continuation Notes (1) -

Credit Card Sales (1) -

Cruiser-Mate (1) -

CT37 Series (1) -

CT45 XP (2) -

CT Series (1) -

Cubi 5 12M (1) -

Cubi N ADL (4) -

CX (1) -

CX CAS (1) -

D1110 (1) -

Defender Series Pro (1) -

Defender Series Pro XT Clear (1) -

Defender Series XT (1) -

Dell Optiplex 5040 (1) -

Desk Lamp (1) -

Digital (1) -

DocuGard (1) -

Dogs by Gary Patterson (1) -

Dynamic (1) -

Easy Office Collection (12) -

Elite (3) -

Elite Mini 805 G8 (1) -

Elite SFF 600 G9 (4) -

EliteDesk (10) -

EliteDesk 8 G1i (3) -

EliteDesk 800 G1 (1) -

Emerald Series (1) -

Employee's Copies Cut Sheet (17) -

Entertainment Monitor (3) -

ES2500 (1) -

ES8500 (1) -

Etagere Organizer (14) -

EVA (1) -

Everything Is Fine (1) -

Evolve 40 (1) -

ExpressCage (1) -

Extended (1) -

Extreme (1) -

EZClean (1) -

Farmhouse Fusion (12) -

FastFit (1) -

Federal & State Remote Worker Binder 1-Year Labor Law Service (1) -

Federal Wage (1) -

Federal, State and Local Labor Law (109) -

FingerGrip (14) -

Firebox T45 (1) -

First Class (2) -

Fore (1) -

Foreman's Time (1) -

Fortress Series (1) -

FX 890II (1) -

Glossy 2-Sided (1) -

Glove Crafter All-Purpose (1) -

Gold (2) -

Gold Standard (2) -

Great White 30 (1) -

Hand Strap (4) -

Health Claim Insurance (1) -

Healthcare Patient Sign-In (1) -

Highland Cows (1) -

HIPAA Notice (1) -

HIPAA Patient Consent and Authorization Form (1) -

Hole punched (1) -

Horizontal (1) -

Hue (5) -

HybridFlex Arts (23) -

Indy Series (12) -

Inspire Series (4) -

Kan't Kopy (4) -

KidProof (3) -

Liberty (6) -

M70s Gen 5 (2) -

Marble (3) -

Money/Rent (4) -

MSA (2) -

Multi-Angle (2) -

MX Keys Mini (3) -

OptiPlex (28) -

OptiPlex 7020 (3) -

OptiPlex 7020 Plus (4) -

OptiPlex 9020 (2) -

Pearl (2) -

Perforated 3 5/8" (2) -

PODS 3-in-1 (3) -

Precision (4) -

Precision 3000 (2) -

Pressure-Seal (7) -

PRO (2) -

PRO DP21 (5) -

Pro Max Micro (3) -

Pro Micro Plus (3) -

Pro SFF 400 G9 (3) -

Pro Slim (6) -

Pro Slim Plus (4) -

ProDesk (15) -

ProFlex 7031 (10) -

ProFlex 7041 (3) -

Purple QD101 (2) -

Quill Brand Continuous Paper (6) -

Quill Brand Multi-part Form (2) -

Raider Series (36) -

Rally Bar (3) -

Revolution (3) -

Revolution Premium Digital (2) -

ShareCradle (2) -

Snap-off (3) -

Somerset (8) -

SoundForm (3) -

STAXONSTEEL (2) -

Stratus Collection (60) -

TaxRight (14) -

TC2x Series (3) -

Teddy Bear KidProof (2) -

Thinkcentre (22) -

ThinkCentre M60q Chromebox (3) -

ThinkCentre M80s Gen 3 (2) -

ThinkCentre M93 (4) -

Thirst Quencher (5) -

Tops Message (2) -

Tri-Fold Folio (2) -

Tru-Form (3) -

Tru-Form Media (2) -

TZ (2) -

TZ670 (3) -

Venture (3) -

Venture Series (85) -

Venture Series Kickstand (3) -

Venture Series Slim (16) -

Venture-X Series (5) -

View 270 Plus TG ARGB (3) -

Vista Collection (12) -

Wall Maps (2) -

WD_BLACK SN8100 (2) -

Write 'N Stick (2) -

XL Series (7)

Series or collection

Top

Quill Brand® Columnar Book, 12-Columns, 80 Pages, Gray Marble (18852/26519)

Item #: 901-217976

Item #: 901-217976

Columnar book for record keeping

Gray marble and made of paper

Includes 80 single-format pages, comes with 12 columns per page, quad-ruled

$17.99

1-2 each

Save 6%

$16.99

3+ each

Quill Brand® Columnar Book, 3-Columns, 80 Pages, Blue Marble (18847/26516)

Item #: 901-217737

Item #: 901-217737

Columnar book for record keeping

Gray marble and made of paper

Includes 80 single-format pages, comes with three columns per page, quad-ruled, 30 lines down per page

$15.99

Per each

Quill Brand® 4-Column Columnar Book, 80 Pages, Blue Marble (18848/26517)

Item #: 901-217745

Item #: 901-217745

Columnar book for record keeping

Blue marble and made of paper

Includes 80 single-format pages, comes with four columns per page, quad-ruled

$25.99

Per each

Staples Ledger Binder, 200 Pages, Blue Marble (26520)

Item #: 901-296509

Item #: 901-296509

Ledger binder is an excellent choice for storing your important documents

Blue marbled cover and white bond paper

Includes 200 pages printed on front and back with green lines

$44.99

Per each

Columnar Book, 6 Columns, 7.25" x 9.5", Blue Granite, 40 Sheets/Book (217752)

Item #: 901-217752

Item #: 901-217752

7 1/4" x 9 1/2"

80 pages per book

Quad ruled

$19.99

Per each

Quill Brand® 2 Columns Columnar Book, 7.25"W x 9.5"H, Gray Marble (18846/26515)

Item #: 901-217729

Item #: 901-217729

Gray marble-look cover

Includes 80 single-format pages, comes with two columns, quad-ruled

Overall dimensions: 7.25"W x 9.5"H

$21.99

Per each

ComplyRight Double Window Envelope for Tax Form, 5.63" x 9", White/Black, 100/Pack (51511)

Item #: 901-24578186

Item #: 901-24578186

Simple high-quality double-window envelope for W-2 (5218) tax form that gets the job done

Dimensions: 5.63" x 9"

Comes in white with black text

Quill Brand® Aluminum Clipboard, Legal, Silver, 8.5" x 14", 1/PK

Item #: 901-1828053

Item #: 901-1828053

Storage clipboard protects and organizes your business forms and documents

Legal sized aluminum clipboard

Low-profile steel clip

ComplyRight 2025 1099-DIV Tax Form Envelopes, 4-Part, 2-Up, Copies A, B, C and/or State, 10/Pack (610710)

Item #: 901-24507967

Item #: 901-24507967

File form 1099-DIV for each person: to whom you have paid dividends (including capital gain dividends and exempt-interest dividends) and other distributions on stock of $10 or more; for whom you have withheld and paid any foreign tax on dividends and

other distributions on stock; for whom you have withheld any federal income tax on dividends under the backup withholding rules; or to whom you have paid $600 or more as part of a liquidation. ...

other distributions on stock; for whom you have withheld any federal income tax on dividends under the backup withholding rules; or to whom you have paid $600 or more as part of a liquidation. ...

Consists of four parts: Copies A, B, C and/or State, 2-Up

ComplyRight 2025 1099-MISC Tax Form Envelopes, 3-Part, 2-Up, Copy A, B, C/2, 1096 Transmittal, 25/Pack (6103E25)

Item #: 901-24578221

Item #: 901-24578221

1099-MISC tax form is designed to report payments made in the course of your business for each person to whom you paid at least 10 dollars in royalties or at least 600 dollars in rents

Consists of three parts

Tax form page format: 2-Up

Sof-Form® Non-sterile Conforming Gauze Bandages; 75" L x 2" W, 96/Pack

Item #: 901-113612MED

Item #: 901-113612MED

Rayon/Polyester Material

Non-sterile

Latex-free

TaxRight 2025 1099-NEC Tax Form Tax Forms, Envelopes & TipSheet, 4-Part, 15/Pack (NECSC6103E15)

Item #: 901-24461405

Item #: 901-24461405

1099-NEC (4-Part) tax form set with envelopes.

Includes (3) 1096 transmittal forms.

Features ComplyRight tips for optimal, compliant use - Covers minimum requirements, penalties, common errors and employer do's and don'ts.

TaxRight 2025 W-2 Tax Form Tax Forms, Envelopes, TipSheet & Software, 4-Part, 10/Pack (SC5645ES10)

Item #: 901-24199724

Item #: 901-24199724

W-2 (4-Part) tax form set with software and envelopes.

Includes (3) W-3 transmittal forms.

Features ComplyRight tips for optimal, compliant use - Covers minimum requirements, penalties, common errors and employer do's and don'ts.

TaxRight 2025 1099-NEC Tax Form Tax Forms, Envelopes & TipSheet, 4-Part, 25/Pack (NECSC6103E25)

Item #: 901-24461401

Item #: 901-24461401

1099-NEC (4-Part) tax form set with envelopes.

Includes (3) 1096 transmittal forms.

Features ComplyRight tips for optimal, compliant use - Covers minimum requirements, penalties, common errors and employer do's and don'ts.

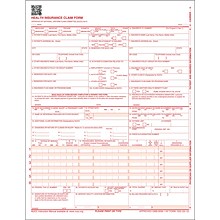

ComplyRight CMS-1500 Health Insurance Claim Form, 250/Box (CMS12LC250)

Item #: 901-CMS12LC250

Item #: 901-CMS12LC250

Approved by the National Uniform Claim Committee (NUCC); HIPAA compliant

This form was revised to align the paper form with some of the changes in the electronic healthcare claims: Professional (837), 005010X222 Technical Report Type 3 (5010) and 005010X222A1 Technical Report Type 3 (5010A1)

The most significant change was the addition of 8 diagnosis codes in field 21

$44.99

Per box

($0.18/EACH)

TaxRight 2025 1099-NEC Tax Form Tax Forms, Envelopes & TipSheet, 4-Part, 50/Pack (NECSC6103E)

Item #: 901-24461402

Item #: 901-24461402

1099-NEC (4-Part) tax form set with envelopes.

Includes (3) 1096 transmittal forms.

Features ComplyRight tips for optimal, compliant use - Covers minimum requirements, penalties, common errors and employer do's and don'ts.

DBS Brady® Re-Form™ 14 1/4"(W) x 150'(L) Plus Heavy Weight Roll Absorbent Pad, 27 gal

Item #: 901-196281ORS

Item #: 901-196281ORS

Capacity volume: 27 gal

Dimensions: 14 1/4"(W) x 150'(L)

For drips, spills, and wiping applications

TaxRight 2025 W-2 Tax Form Tax Forms, Envelopes, TipSheet & Software, 6-Part, 10/Pack (SC5650ES10)

Item #: 901-24202435

Item #: 901-24202435

W-2 (6-Part) tax form set with software and envelopes.

Includes (3) W-3 transmittal forms.

Features ComplyRight tips for optimal, compliant use - Covers minimum requirements, penalties, common errors and employer do's and don'ts.

ComplyRight 2025 1099-NEC Tax Form Self-seal envelopes, 3-Part, 3-Up, Copy A, B, C/2, 1096 Transmittal, 50/Pack (NEC6102E)

Item #: 901-24578218

Item #: 901-24578218

1099-NEC tax form is created for companies to report payments made to an individual who performed services in the course of business as a nonemployee

Consists of three parts

Tax form page format: 3-Up

ComplyRight 2025 1099-MISC Tax Form Self-seal envelopes, 3-Part, 2-Up, Copy A, B, C/2, 1096 Transmittal, 25/Pack (6102E25)

Item #: 901-24578220

Item #: 901-24578220

1099-MISC tax form is designed to report payments made in the course of your business for each person to whom you paid at least 10 dollars in royalties or at least 600 dollars in rents

Consists of three parts

Tax form page format: 2-Up

Permatex® Form-A-Gasket® Sealants, 3 oz, tube

Item #: 901-710567ORS

Item #: 901-710567ORS

Black gasket sealants for efficient sealing and bonding

3 oz. tube for convenient application

Flexible sealant can be used on non-rigid and vibrating surfaces

ComplyRight 2025 1099-INT Tax Form Envelopes, 4-Part, 2-Up, Copies A, B, C, 10/Pack (6106E10)

Item #: 901-24507936

Item #: 901-24507936

File form 1099-INT, interest income, for each person: to whom you paid amounts of at least $10 (or at least $600 of interest paid in the course of your trade or business)

4-Part Set with Envelopes, Copies A, B, C, 2-Up

1 Page Equals 2 Forms

ComplyRight 2025 1099-NEC Tax Form 25 self-seal envelopes, 4-Part, 3-Up, Copy A, B, C/2, 1096 Transmittal, 25/Pack (NEC6103E25)

Item #: 901-24578199

Item #: 901-24578199

1099-NEC (nonemployee compensation) is an IRS form created for companies to report payments made to an individual who performed services in the course of business as a nonemployee

Includes four-part tax forms

3-Up forms: three forms on a single sheet

Adams Gummed Double Window 1095 B&C Tax Form Envelopes, 5-5/8" x 9", White, 100/Pack (DW1095BC18-S)

Item #: 901-DW1095BC18

Item #: 901-DW1095BC18

Double Window Security Envelopes - 5-5/8" x 9"

For 1095B and 1095C ACA Tax Forms

Top Window - 3-7/16" x 1", Bottom Window - 3-7/16" x 3/4"

Add to cart QViewInfoHolder

Edit Delivery frequency