Page 4 of replacement superbill forms

(3013 items found)

Filter by:

Sort by:

Best match

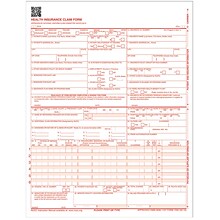

TOPS Centers for Medicare and Medicaid Services Forms, 8-1/2" x 11", 250/Pack (50135RV)

Item #: 901-2408453

CMS-1500 claim forms (formerly known as HCFA-1500 claim forms) expedite Medicare, Medicaid or private insurance benefits

Top sensor bar for microfiche duplication, as required in some states

OCR red ink for scanning

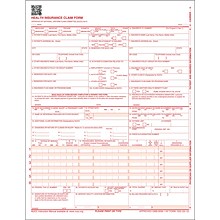

ComplyRight CMS-1500 Health Insurance Claim Form, 250/Box (CMS12LC250)

Item #: 901-CMS12LC250

Approved by the National Uniform Claim Committee (NUCC); HIPAA compliant

This form was revised to align the paper form with some of the changes in the electronic healthcare claims: Professional (837), 005010X222 Technical Report Type 3 (5010) and 005010X222A1 Technical Report Type 3 (5010A1)

The most significant change was the addition of 8 diagnosis codes in field 21

ComplyRight 2025 1099-NEC Tax Form Envelopes, 4-Part, 3-Up, Copy A, B, C/2, 1096 Transmittal, 100/Pack (NEC6103E100)

Item #: 901-24578201

1099-NEC tax form set is created for companies to report payments made to an individual who performed services in the course of business as a nonemployee

Consists of four parts

3-up page format: three forms on a single sheet

Medical Arts Press Dental Registration Forms, 250/Pack (20558)

Item #: 901-20558NP

Type of form: Dental registration form

250 per pack

Size: 8 1/2" x 11"

Adams 2025 W-2 Tax Form, 1-Part, Copy 1/D, 100/Pack (LW2ERQ)

Item #: 901-5204

2025 1-Part W-2 Copy 1 or D Forms for up to 100 employees

2025 W-2 forms must be mailed or eFiled to the SSA and furnished to your employees by February 2, 2026; IRS eFile regulations require e-Filing for 10 or more returns of certain forms; Use Adams Tax Forms Helper to eFile to the IRS/SSA

1-Part W-2 Copy 1/D sheets

Adams 2025 W-2 Tax Form, 1-Part, Copy C, 100/Pack (LW2EEC2)

Item #: 901-5203

2025 1-Part W-2 Copy C or 2 Forms for up to 100 employees

2025 W-2 forms must be mailed or eFiled to the SSA and furnished to your employees by February 2, 2026; IRS eFile regulations require e-Filing for 10 or more returns of certain forms; Use Adams Tax Forms Helper to eFile to the IRS/SSA

1-Part W-2 Copy C/2 sheets

ComplyRight 2025 W-2 Tax Form Envelopes/Recipient Copy Only (No Backer), 1-Part, 4-Up, 50/Pack (5221E)

Item #: 901-24578231

W-2/1099 recipient-only tax form with envelope is designed for organizations that will be required to e-file and therefore will not need Copy A or transmittal forms 1096 or W-3

Tax form page format: 4-up

50 tax forms per pack

Adams Employee's Copies Cut Sheet 2025 W-2 Tax Form, 1-Part, Copy B, C, 2, 100/Pack (LW24UPALT100)

Item #: 901-5205

2025 4 Corner W-2 Forms for 100 employees

2025 W-2 forms must be mailed or eFiled to the SSA and furnished to your employees by February 2, 2026; IRS eFile regulations require e-Filing for 10 or more returns of certain forms; Use Adams Tax Forms Helper to eFile to the IRS/SSA

W-2 forms include Copies B, 2, C, 2 in 4 per sheet format

ComplyRight 2025 1099-DIV Tax Form Envelopes, 4-Part, 2-Up, Copies A, B, C and/or State, 10/Pack (610710)

Item #: 901-24507967

File form 1099-DIV for each person: to whom you have paid dividends (including capital gain dividends and exempt-interest dividends) and other distributions on stock of $10 or more; for whom you have withheld and paid any foreign tax on dividends and

other distributions on stock; for whom you have withheld any federal income tax on dividends under the backup withholding rules; or to whom you have paid $600 or more as part of a liquidation. ...

other distributions on stock; for whom you have withheld any federal income tax on dividends under the backup withholding rules; or to whom you have paid $600 or more as part of a liquidation. ...

Consists of four parts: Copies A, B, C and/or State, 2-Up

Adams Employee's Copies Cut Sheet 2025 W-2 Tax Form, 5-Part, 2000/Carton (LW24UPBBULK-S)

Item #: 901-920128

2025 Blank W-2 Forms have Copy B & C instructions printed on the back

2025 W-2 forms must be mailed or eFiled to the SSA and furnished to your employees by February 2, 2026; IRS eFile regulations require e-Filing for 10 or more returns of certain forms; Use Adams Tax Forms Helper to eFile to the IRS/SSA

W-2 forms include Blank Fronts with Copy B & C instructions printed on the back

ComplyRight 2025 1099-MISC Tax Form Envelopes/Recipient Copy Only, 3-Part, 25/Pack (6112E25)

Item #: 901-24578202

Recipient-only tax form with envelope designed for organizations that will be required to e-file, and therefore will not need Copy A or transmittal forms 1096 or W-3

Consists of three parts

25 tax forms with envelopes per pack

Adams 2025 1099-NEC Tax Form, 1-Part, 100/Pack (LNECPAY2)

Item #: 901-LNECPAY2

2025 1-Part 1099-NEC Copy 1 or 2 Forms for 150 recipients

The 2025 1099-NEC must be mailed or eFiled to the IRS and furnished to your recipients by February 2, 2026; As of 2023, IRS eFile regulations require e-Filing for 10 or more returns of certain forms; Use the new Adams Tax Forms Helper to eFile to the

IRS/SSA ...

IRS/SSA ...

ComplyRight 2025 1099-NEC Tax Form Recipient Copy Only, 3-Part, 3-Up, Copy B, C/2, 50/Pack (NEC6113)

Item #: 901-24578203

1099-NEC recipient-only tax form set designed for organizations that will be required to e-file, and therefore will not need Copy A or transmittal forms 1096 or W-3

Includes three-part tax forms

3-Up forms: three forms on a single sheet

ComplyRight 2025 1099-DIV Tax Form, 1-Part, 2-Up, Federal Copy A, 50/Pack (513050)

Item #: 901-24507956

File form 1099-DIV for each person: to whom you have paid dividends (including capital gain dividends and exempt-interest dividends) and other distributions on stock of $10 or more; for whom you have withheld and paid any foreign tax on dividends and

other distributions on stock; for whom you have withheld any federal income tax on dividends under the backup withholding rules; or to whom you have paid $600 or more as part of a liquidation. ...

other distributions on stock; for whom you have withheld any federal income tax on dividends under the backup withholding rules; or to whom you have paid $600 or more as part of a liquidation. ...

Federal Copy A, 2-Up

ComplyRight 2025 W-2 Tax Form Envelopes/Recipient Copy Only, 1-Part, 4-Up, Copy B, C, 2 and 2 combined, 50/Pack (5205E)

Item #: 901-24578181

W-2 recipient-only tax form with envelope is designed for organizations that will be required to e-file, and therefore will not need Copy A or transmittal forms 1096 or W-3

4-up page format

Includes copies B, C, 2 and 2 combined

ComplyRight 2025 1099-NEC Tax Form Self-seal envelopes, 3-Part, 3-Up, Copy A, B, C/2, 1096 Transmittal, 50/Pack (NEC6102E)

Item #: 901-24578218

1099-NEC tax form is created for companies to report payments made to an individual who performed services in the course of business as a nonemployee

Consists of three parts

Tax form page format: 3-Up

ComplyRight 2025 1099-MISC Tax Form, 2-Part, 2-Up, 50/Pack (510850)

Item #: 901-24507910

File the 1099-MISC form for each person in the course of your business to whom you have paid at least $10 in royalties or broker payments in lieu of dividends and various other income payments

2-up form

For laser printers

ComplyRight 2025 1099-R Tax Form, 1-Part, 2-Up, Federal Copy A, 50/Pack (514050)

Item #: 901-24507973

File form 1099-R for each person to whom you have made a distribution of $10 or more from profit-sharing or retirement plans, any individual retirement arrangements (IRAs), annuities, and more

Federal Copy A, 2-Up

1 Page Equals 2 Forms

ComplyRight 2025 1099-NEC Tax Form Envelopes/Recipient Copy Only, 2-Part, 3-Up, Copy B, C/2, 50/Pack (NEC6113E)

Item #: 901-24578213

1099-NEC recipient-only tax form designed for organizations that will be required to e-file and therefore will not need Copy A or transmittal forms 1096 or W-3

Consists of two parts

Tax form page format: 3-Up

ComplyRight 2025 1099-INT Tax Form, 1-Part, 2-Up, Copy A, 50/Pack (512050)

Item #: 901-24507923

File form 1099-INT, interest income, for each person: to whom you paid amounts of at least $10 (or at least $600 of interest paid in the course of your trade or business)

Federal Copy A, 2-Up

1 Page Equals 2 Forms

ComplyRight 2025 1099-NEC Recipient Copy Only Tax Form, Envelopes and LaserLink Software, 3-Part, 3-Up, White, 50/Pack

Item #: 901-24614850

1099-NEC Blank Tax Form, No Backer (50), Self-Seal Envelopes (50) and LaserLink Software – 1 Page Equals 3 Forms

Includes LaserLink software: A simple, efficient desktop software application for preparing 1099s and W-2s. Backed by reliable, Windows-based functionality, this software provides the features you need to print or e-file your 1099 and W-2 forms.

Pack of 50

ComplyRight 2025 1099-MISC Tax Form Envelopes/Recipient Copy Only, 3-Part, 50/Pack (6112E)

Item #: 901-24578223

1099-MISC recipient-only blank tax form designed for organizations that will be required to e-file and therefore will not need Copy A or transmittal forms 1096 or W-3

Consists of three parts

Includes a universal blank with stub for all 1099-MISC, 1099-INT, 1099-R, 1099-DIV, and 1099-B forms

ComplyRight 2025 W-2 Blank Tax Form, 3-Up, 500/Pack (5211B)

Item #: 901-24650556

Blank form with Backer Instructions and Stub

3-Up

Pack of 500 Forms

Adams Employee's Copies Cut Sheet 2025 Blank W-2 Tax Form, 1-Part, 2-Up, 100/Pack (BLW2Q)

Item #: 901-5207

2025 Blank W-2 Forms for up to 100 employees

2025 W-2 forms must be mailed or eFiled to the SSA and furnished to your employees by February 2, 2026; IRS eFile regulations require e-Filing for 10 or more returns of certain forms; Use Adams Tax Forms Helper to eFile to the IRS/SSA

Blank W-2 forms with blank backers