Page 5 of replacement superbill forms

(3013 items found)

Filter by:

Sort by:

Best match

ComplyRight 2025 1094-C Tax Form, 1-Part, White/Black, 50/Pack (1094CT50)

Item #: 901-24507962

1094-C Transmittal Of Employer-Provided Health Insurance Offer And Coverage Information Returns For Form 1095C.

Pack of 50 forms

Three page form.

ComplyRight 2025 Blank Tax Form for 1099, 1098, 5498, 3-Up, 1500/Pack (5145B)

Item #: 901-24650549

Blank Tax Form for 1099, 1098, 5498

Horizontal Perforations without Stub

Pack of 1,500 Forms

ComplyRight 2025 1099-R Blank Tax Form, 4-Up, 500/Pack (5221B)

Item #: 901-24650557

Blank Form for 1099-R / W-2 without Backer

4-Up

Pack of 500 Forms

ComplyRight 2025 1099-MISC Tax Form, 1-Part, 2-Up, Recipient Copy B, 50/Pack (511150)

Item #: 901-24507960

File form 1099-MISC for each person in the course of your business to whom you have paid during the year

Single-part, 2-up: Recipient Copy B

For laser printers

ComplyRight 2025 1099-MISC Tax Form Envelopes and Recipient Copy Only, 3-Part, 2-Up, Copy B, C/2, 50/Pack (6113E)

Item #: 901-24578226

1099-MISC recipient-only tax form with envelope is designed for organizations that will be required to e-file, and therefore will not need Copy A or transmittal forms 1096 or W-3

Consists of three parts

2-up format: one sheet equals two forms

ComplyRight 2025 W-2 Tax Form, 6-Part, 2-Up, 50/Pack (5650E)

Item #: 901-24650567

Form W-2 and transmittal Form W-3 for reporting wages and tax statements

6-Part Set Includes: Copy A, B, C, 2, D, 1 (25 Sheets each) 3 Transmittals and 50 Self-Seal Envelopes

2-Up: 2 Forms per Sheet

Adams Employee's Copies Cut Sheet 2025 Blank W-2 Tax Form, 4-Part, 50/Pack (BL1099-S)

Item #: 901-920002

Blank forms can be used for W-2 or 1099 tax forms

3-down style with perforations

Blank front and back

ComplyRight 2025 W-2 Tax Form, 2-Part, 2-Up, Employee Copy C, 50/Pack (520350)

Item #: 901-24507933

W-2 form provides wage and income information to your employees, the SSA, the IRS, and state and local governments

2-up: Employee Copy C and/or State, City, or Local Copy 2

For laser printers

ComplyRight 2025 1099 Tax Form, 2-Part, 2-Up, 50/Pack (514450)

Item #: 901-24507955

Use this universal 1099 blank tax form to file a 1099-MISC, 1099-INT, 1099-R, 1099-DIV, or 1099-B

2-up form contains stub

For laser printers

ComplyRight 2025 W-2 Tax Form, Employee’s Copies B, C, 2 & 2 Combined, 4-Up, 25/Pack (520525)

Item #: 901-24650545

Copies B, C, 2 & 2 Combined

4-Up (Box)

Pack of 25 Forms

ComplyRight 2025 W-2 Tax Form, 1-Part, 3-Up, Employee Copy B, C, and 2, 50/Pack (521050)

Item #: 901-24507947

Form W-2 provides wage and income information to your employees, the SSA, the IRS, and state and local governments

Single-part, 3-up (horizontal): Employee Copies B, C, and 2 combined

For laser printers

ComplyRight 2025 1099-K Tax Form, 1-Part, 2-Up, Copy A, 50/Pack (532525)

Item #: 901-24650546

Use the Form 1099-K for payments made in settlement of reportable payment transactions for each calendar year

2-Up: 2 Forms per Sheet

Pack of 50 forms

ComplyRight 2025 W-2 Tax Form, 4-Part, 4-Up, 50/Pack (522150)

Item #: 901-24507919

W-2/1099-R form provides wage and income information to your employees, the SSA, the IRS, and state and local governments

4-Up, 4 Corner W-2 and 1099-R blank, no backer

For laser printers

ComplyRight 2025 1099-R Tax Form, 1-Part, 2-Up, Recipient Copy B, 50/Pack (514150)

Item #: 901-24507943

File form 1099-R for each person to whom you have made a distribution of $10 or more from profit-sharing or retirement plans, any individual retirement arrangements (IRAs), annuities, and more

Recipient Copy B, 2-Up

1 Page Equals 2 Forms

ComplyRight 2025 W-2 Tax Form, 1-Part, 2-Up, Employee Copy B, 50/Pack (520250)

Item #: 901-24507925

W-2 form provides wage and income information to your employees, the SSA, the IRS, and state and local governments

Single-part, 2-up : Employee IRS Federal Copy B

For laser printers

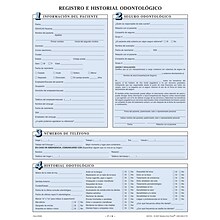

Medical Arts Press Dental Registration Forms Featuring Updates Section; Sky Blue, Spanish (20743)

Item #: 901-20743

Collects printed name and relationship to patient

Medication list requests correlating diagnosis

Screens for artificial heart valves, artificial joints, heart

ComplyRight 2025 W-2 Tax Form Recipient Copy Only, 5-Part, 2-Up, Copy B, C/2, D/1, 50/Pack (5648)

Item #: 901-24578222

W-2 recipient-only tax form set designed for organizations that will be required to e-file, and therefore will not need Copy A or transmittal forms 1096 or W-3

Includes five-part tax forms

2-Up forms: two forms on a single sheet

ComplyRight 2025 1099-MISC Tax Form, 1-Part, 2-Up, Payer Copy C, 50/Pack (511250)

Item #: 901-24507969

File form 1099-MISC for each person in the course of your business to whom you have paid during the year

Single-part, 2-up: Payer Copy C

For laser printers

ComplyRight 2025 Double-Window Envelopes For 1099-R Tax Forms, 4-Up Box, Self-Seal, Pack Of 100

Item #: 901-24650541

Double-window envelope accommodates 4-Up 1099-R (5175) forms.

Features a self-seal flap.

Pack of 100 envelopes.

ComplyRight 2025 1095-C Tax Form, 1-Part, 500/Pack (1095C500)

Item #: 901-24507953

1095-C tax form

Single-part

Laser printer compatible

ComplyRight 2025 1095-C Tax Form, 1-Part, White/Black, 25/Pack (1095CIRS25)

Item #: 901-24507922

1095-C tax form

Single-part

For laser printers

ComplyRight 2025 W-2 Tax Form Envelopes/Recipient Copy Only, 5-Part, 2-Up, Copy B, C/2, D/1, 25/Pack (5648E25)

Item #: 901-24578230

Recipient-only tax form with envelope is designed for organizations that will be required to e-file and therefore will not need Copy A or transmittal forms 1096 or W-3

Consists of five parts

2-up format: one sheet equals two forms

ComplyRight 2025 1099-MISC Tax Form, 3-Part, 2-Up, 50/Pack (6102E)

Item #: 901-24650569

3-Part Set: Copy A, B, State/File (25 sheets each), transmittals (3) and Self-Seal Envelopes (50)

2-Up: 2 Forms per Sheet

For 50 Employees

ComplyRight 2025 1099-DIV Tax Form, 1-Part, 2-Up, Recipient Copy B, 50/Pack (513150)

Item #: 901-24507951

File form 1099-DIV for each person: to whom you have paid dividends (including capital gain dividends and exempt-interest dividends) and other distributions on stock of $10 or more; for whom you have withheld and paid any foreign tax on dividends and

other distributions on stock; for whom you have withheld any federal income tax on dividends under the backup withholding rules; or to whom you have paid $600 or more as part of a liquidation. ...

other distributions on stock; for whom you have withheld any federal income tax on dividends under the backup withholding rules; or to whom you have paid $600 or more as part of a liquidation. ...

Recipient Copy B, 2-Up